Introduction

This article covers how to create a Supplier Credit Note, which is issued to your supplier informing them of a reduction in the amount that your supplier owes you.

A credit note is usually issued because of an error in a previously issued invoice. A Supplier Credit Note usually states the reason it’s being issued for and references the invoice that it offsets.

Before you begin

Check with your company’s sales management process if you should cancel the supplier bill instead of creating a Supplier Credit Note.

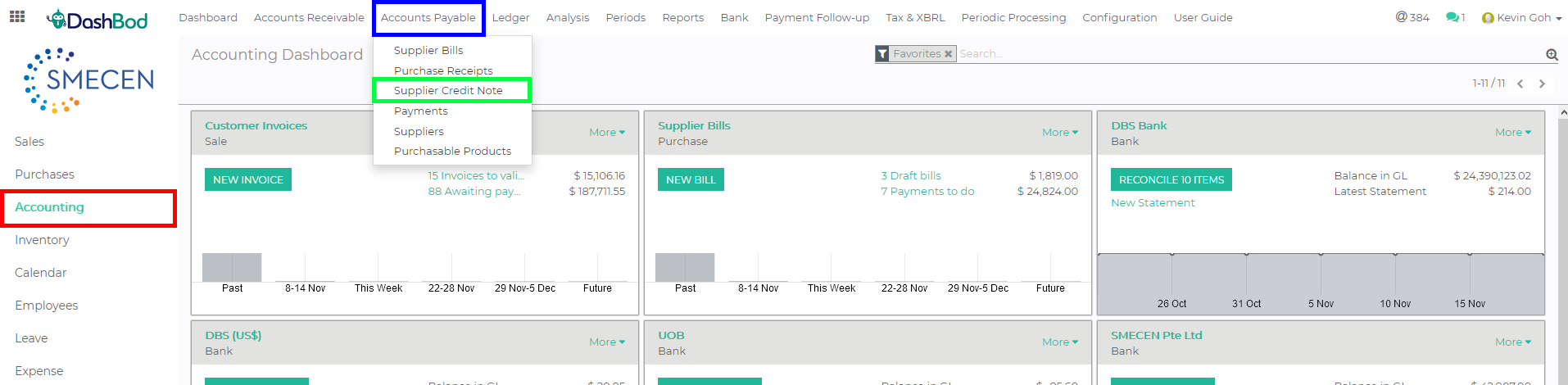

Navigating to Supplier Credit Note page

1. Click on Accounting at the left panel (Red Box)

2. Click on Accounts Payable at the top bar (Blue Box)

3. Click on Supplier Credit Note (Green Box)

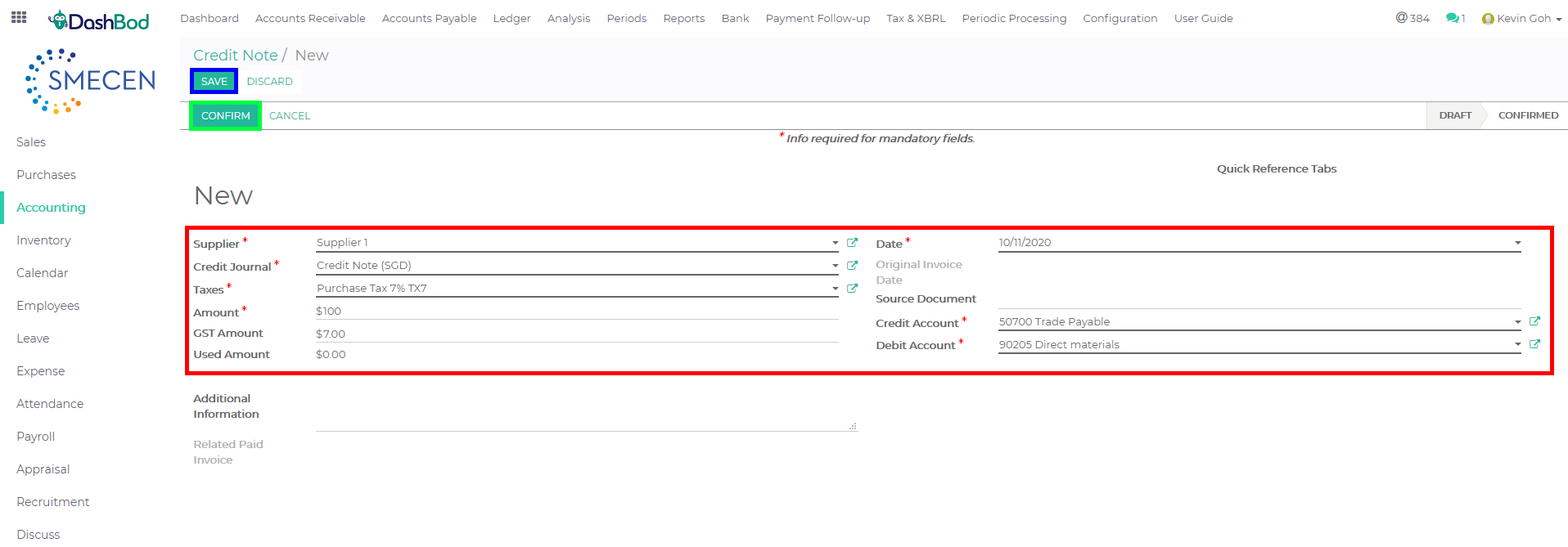

Creating Supplier Credit Note

4. Click Create

5. Fill up the following fields (Red Box)

-

- Supplier

- Taxes

- Amount – Enter the amount without tax

- Date

- Credit Account – Select your crediting account accordingly

- Debit Account – Select your debiting account accordingly

6. Click Save (Blue Box)

7. Click Confirm once done (Green Box)

What’s Next

After creating a credit note you may now apply the credit note to an invoice.