Introduction

Employers are required by law to prepare form IR8A and/or IR8S, which are compulsory for all employees working in Singapore to complete.

DashBod saves you time by auto-computing and generating the IR8A and/or IR8S for all your staff including part-timers.

Before you begin

Note: You can only use this function if you’ve been doing your payroll for the entire year with DashBod.

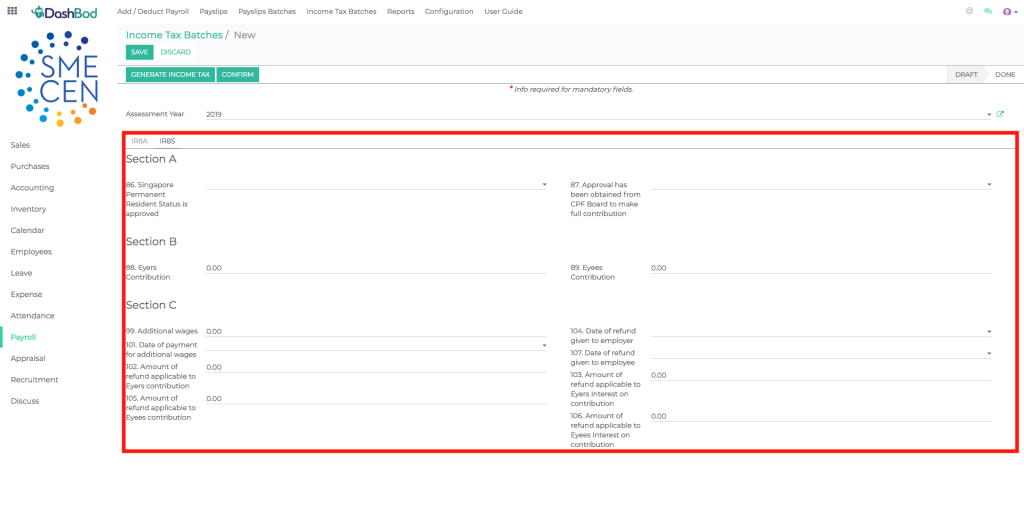

IR8S forms are only required if:

- An employer has made excess CPF contributions on your employees’ wages

and/or

- The employer has claimed or is going to claim a refund on excess CPF contributions

How it works

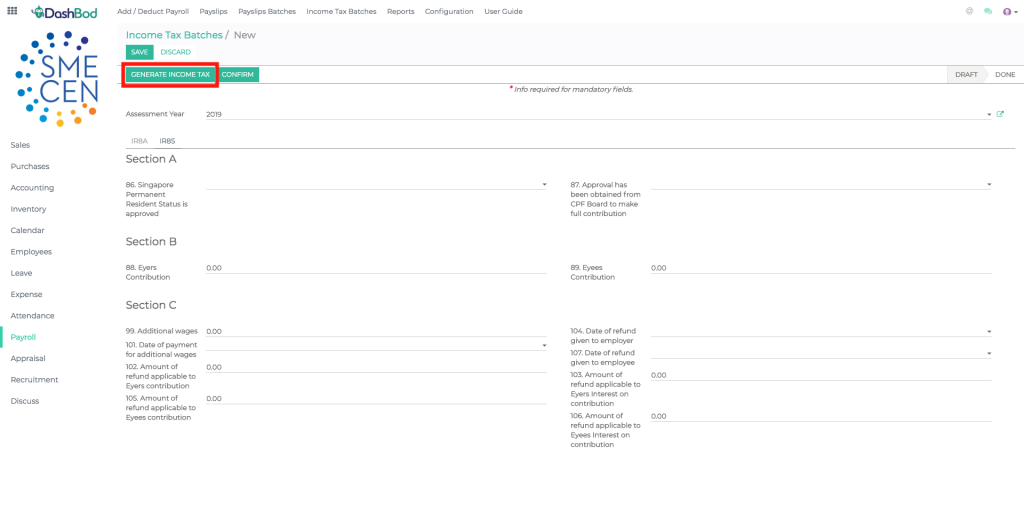

Creating Income Tax in Batches

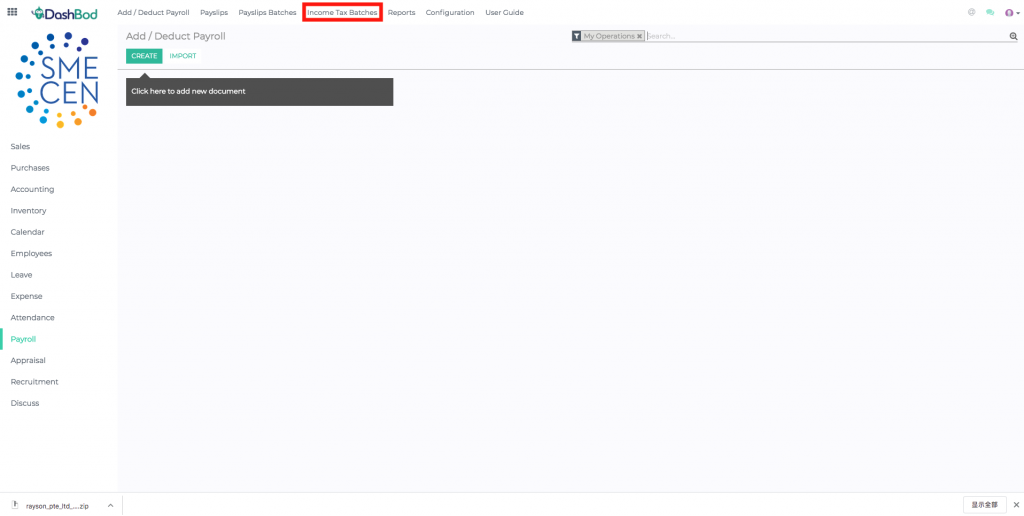

HR – Payroll > Income Tax Batches

Please follow the following steps:

- HR – Payroll Module. On the top bar, Select Income Tax Batches

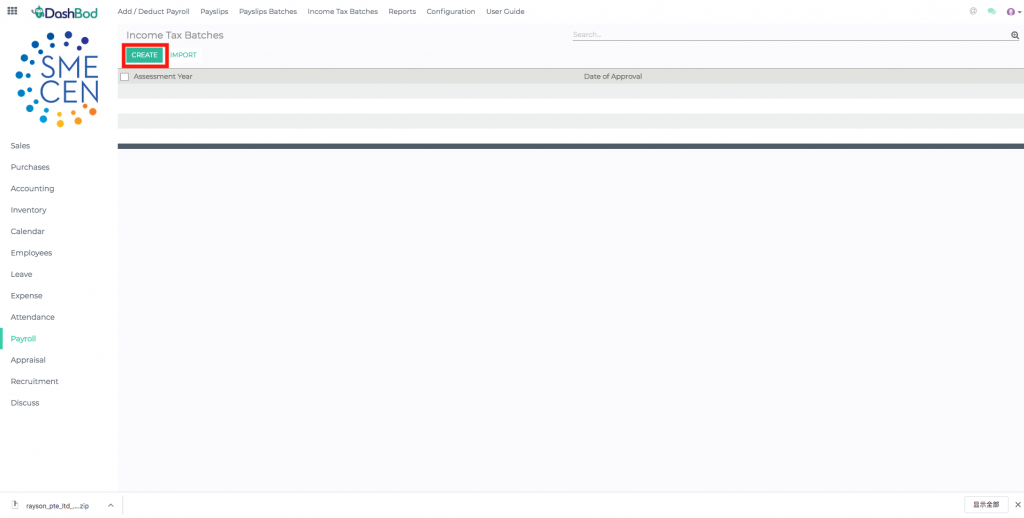

- Click Create

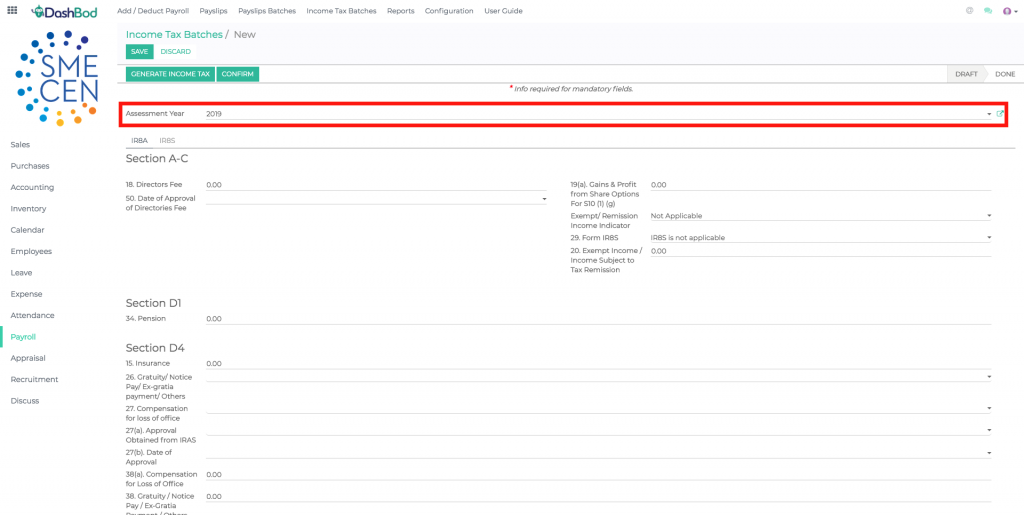

- Input Assessment Year details

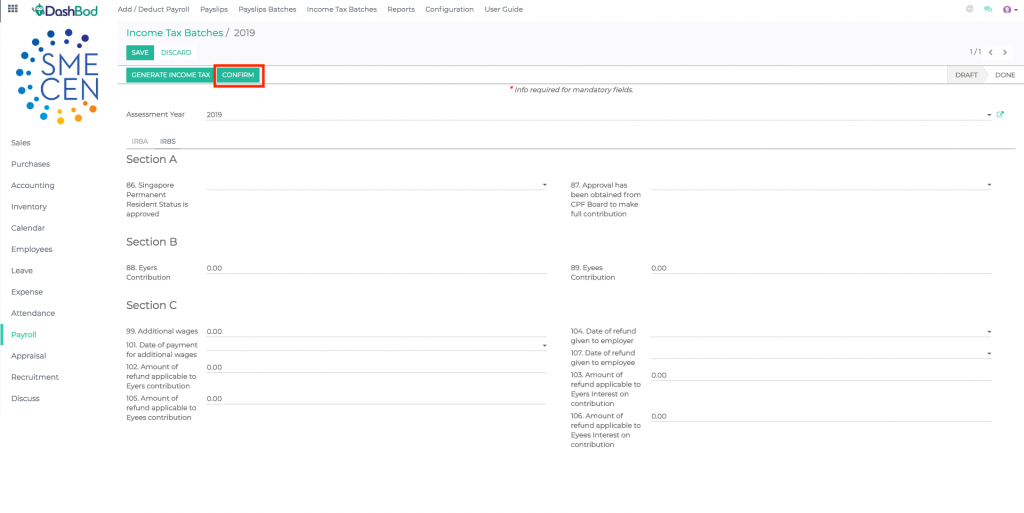

- Input the relevant information for IR8A and/or IR8S tabs

- Click Generate Income Tax

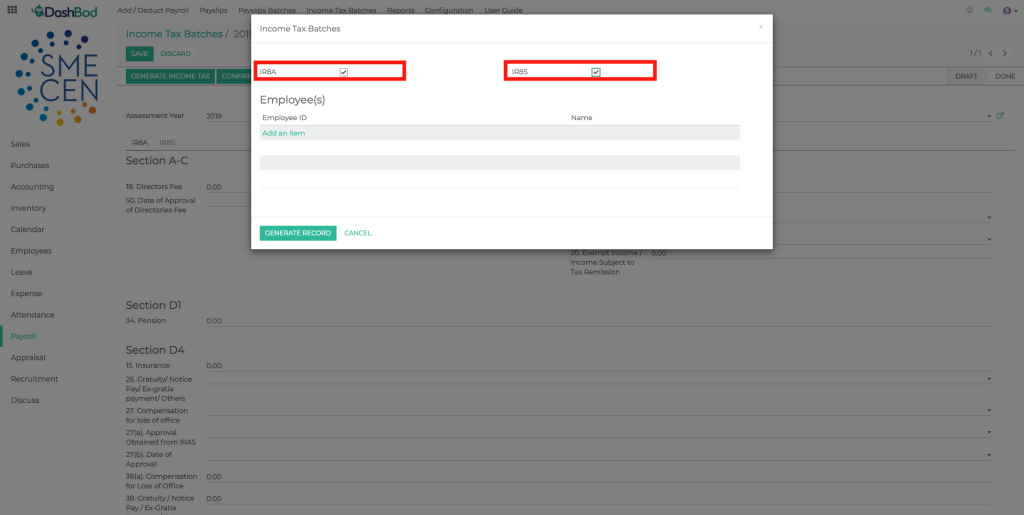

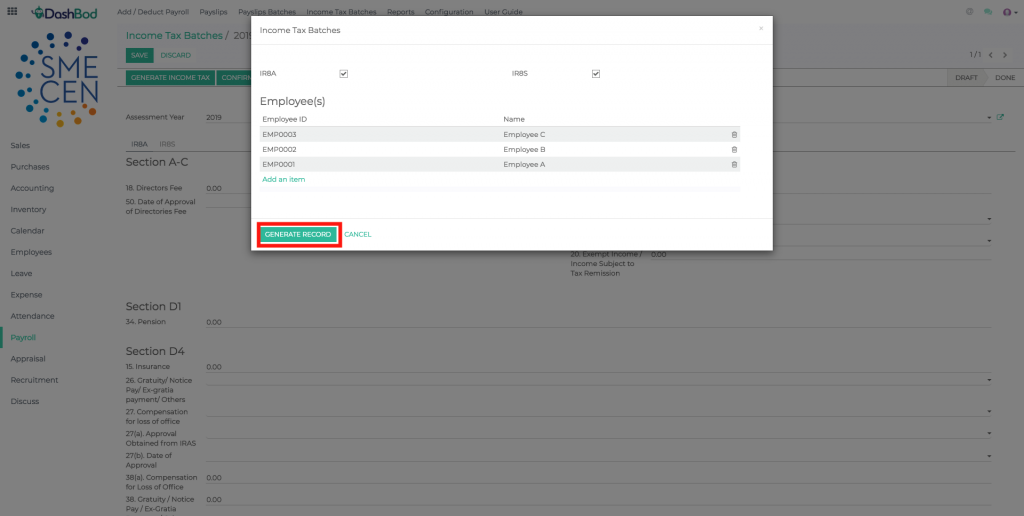

- Select IR8A and/or IR8S

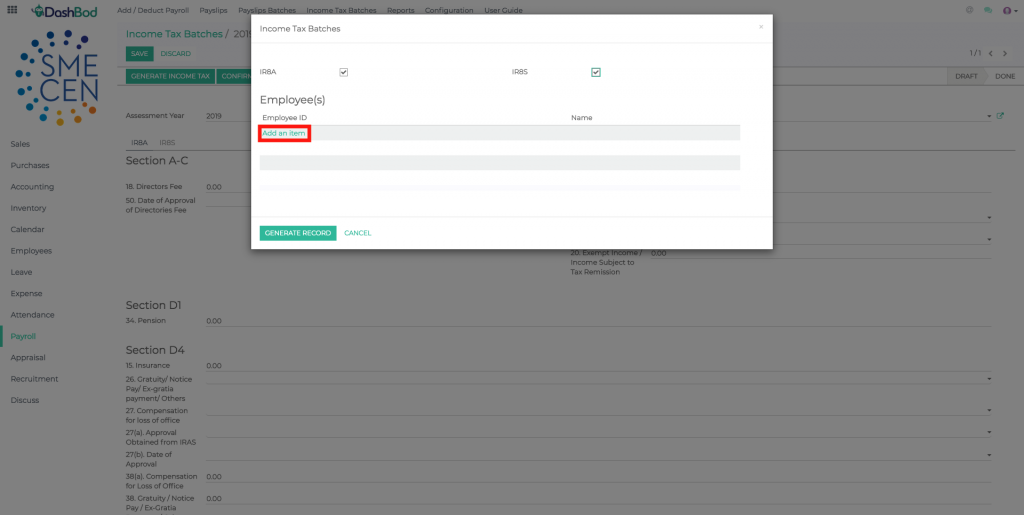

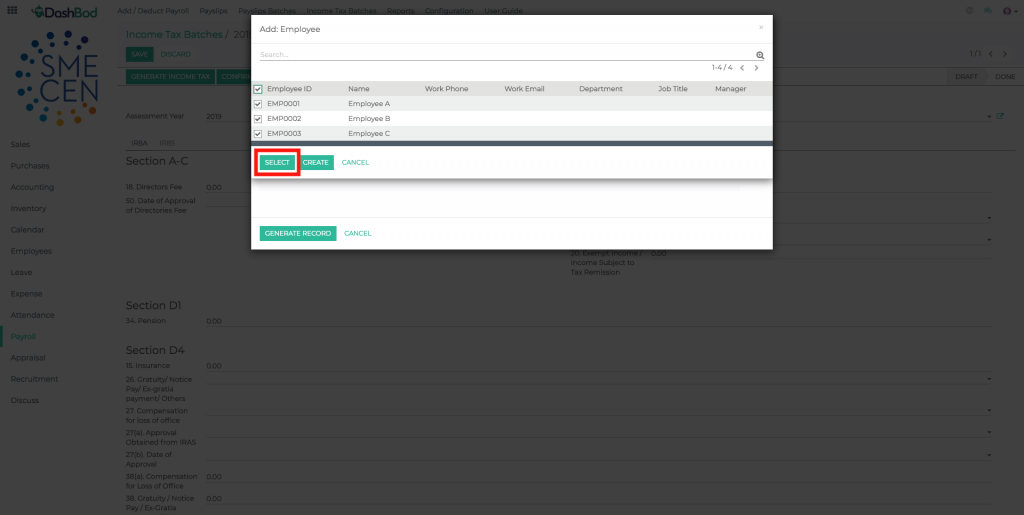

- Click Add an item

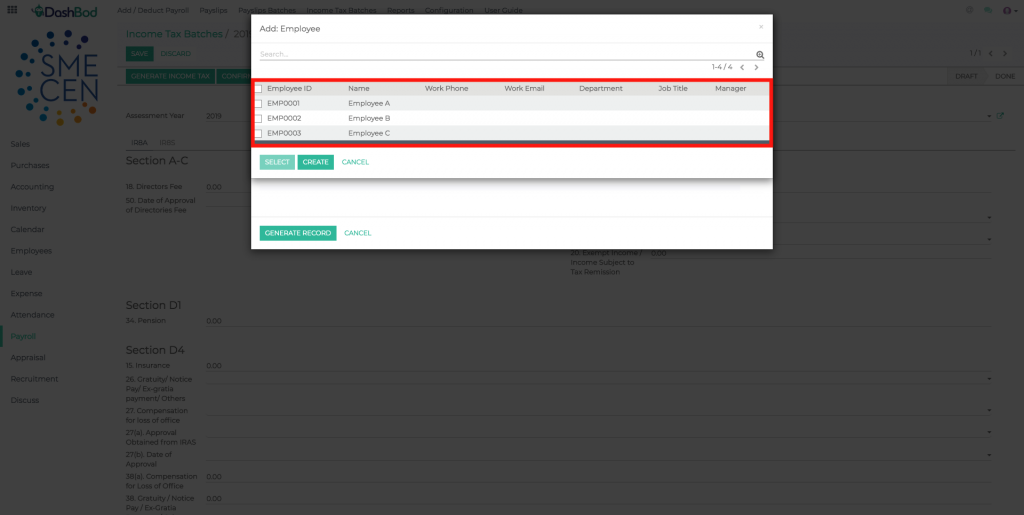

- Select the employees

- Click Select

- Click Generate Record

- Click Confirm

What’s Next

Report your companies corporate income to IRAS by generating a Form C-S here.