Introduction

It is compulsory for all companies in Singapore to report their income to IRAS annually by filing their Corporate Income Tax Return, also known as Form C-S.

With DashBod’s integration with IRAS seamless filing, you will be able to file your tax return directly to IRAS.

However, you will also be able to print the Form C-S for manual submission if you choose to do so.

Before you Begin

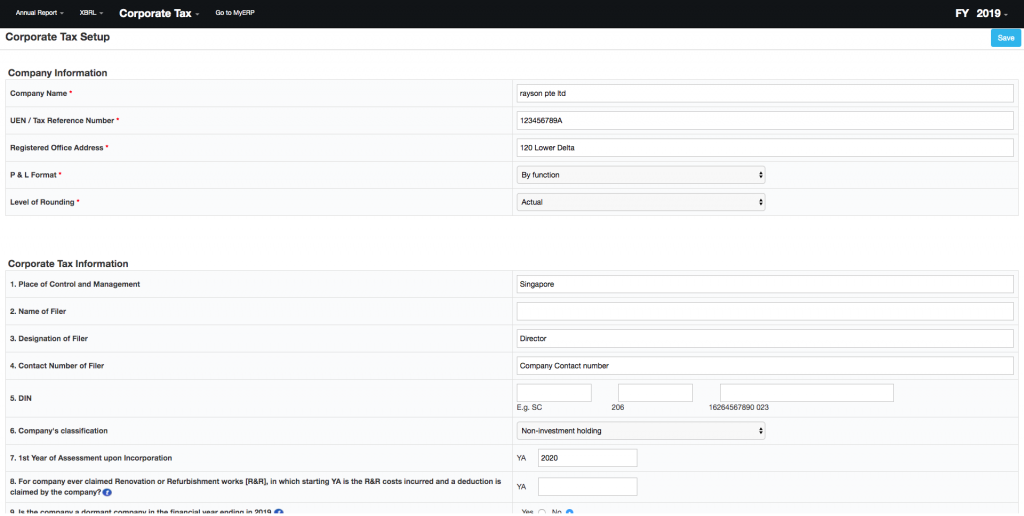

Ensure that every field is filled up accurately and provides a true account of your company’s income.

How it Works

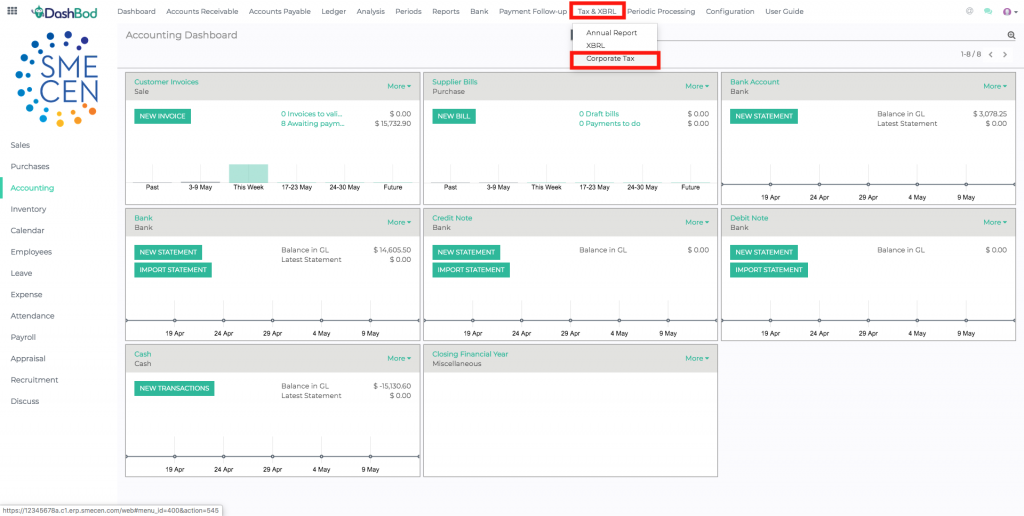

Accounting – Finance Module on the top bar, Select Tax & XBRL > Corporate Tax

- Open up the Tax & XBRL and click on Corporate Tax

- Input the relevant details for the report

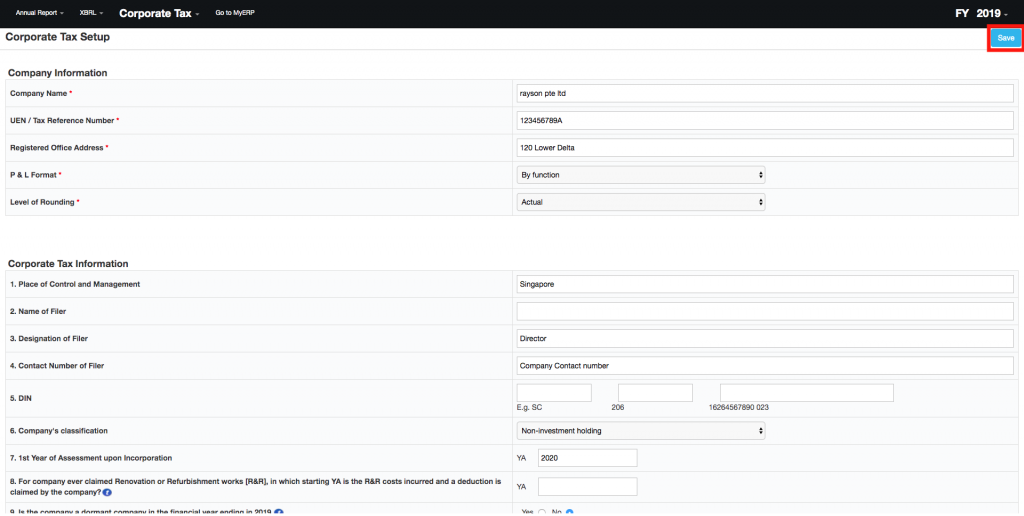

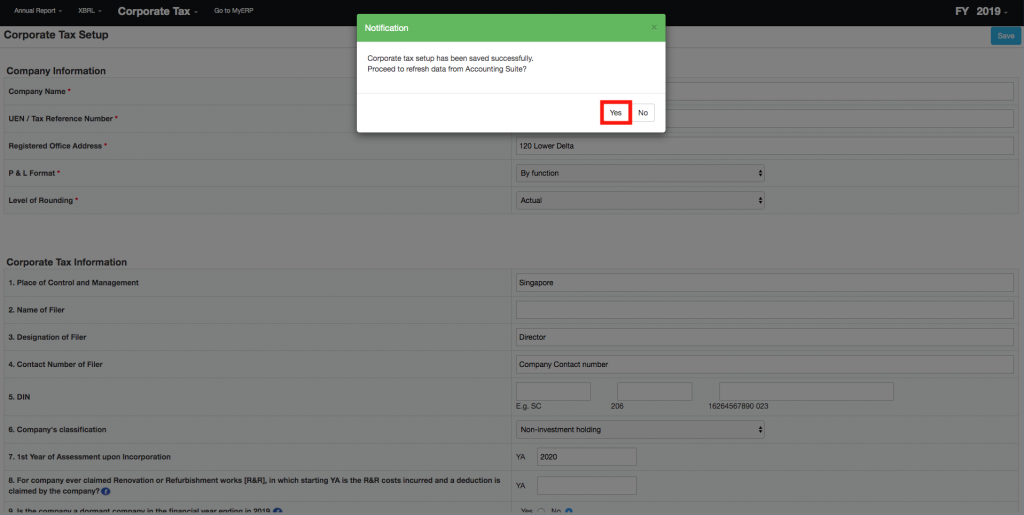

- Click Save

- Click Yes

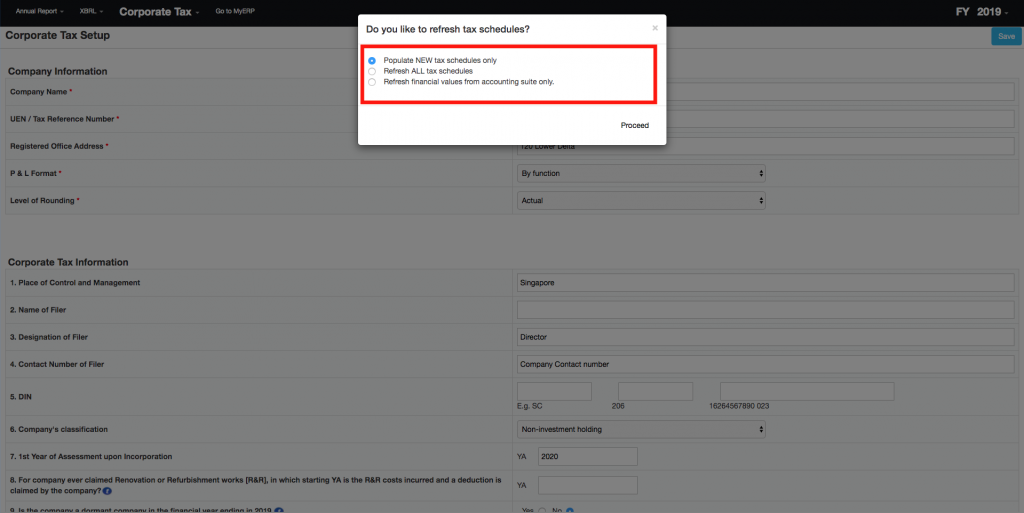

- Choose either of these 3 choices for the report:

- Populate new tax schedules only

Refresh all tax schedules

Refresh financial values from accounting suite only

- Populate new tax schedules only

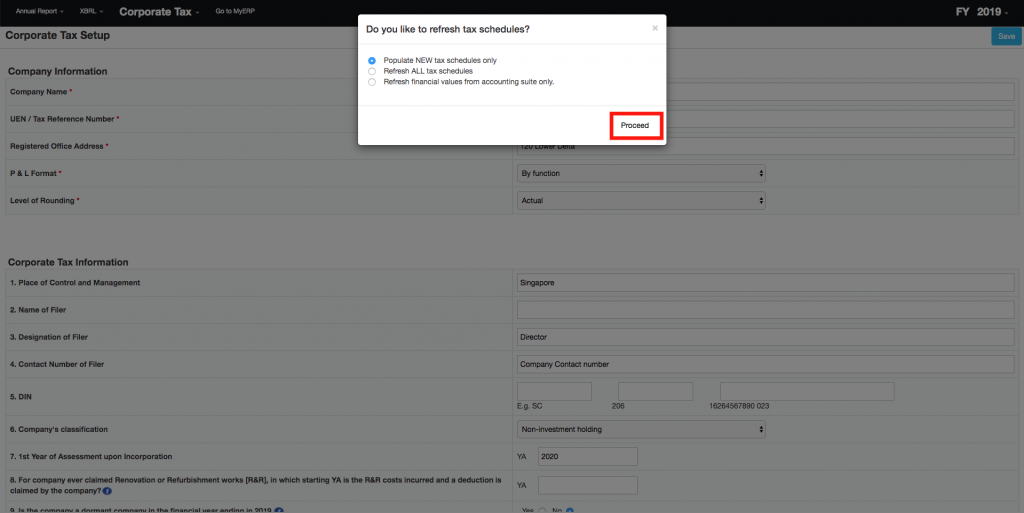

- Click Proceed when completed

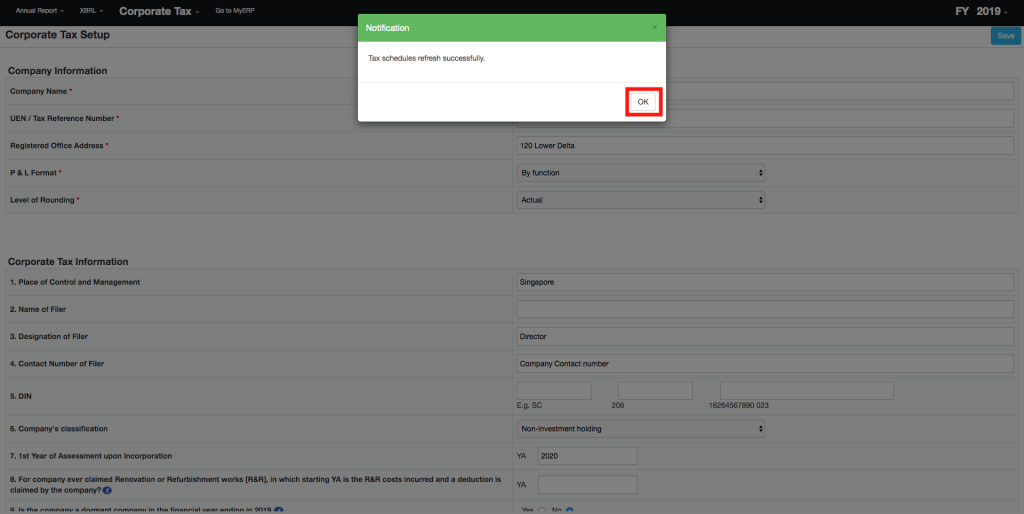

- Click OK

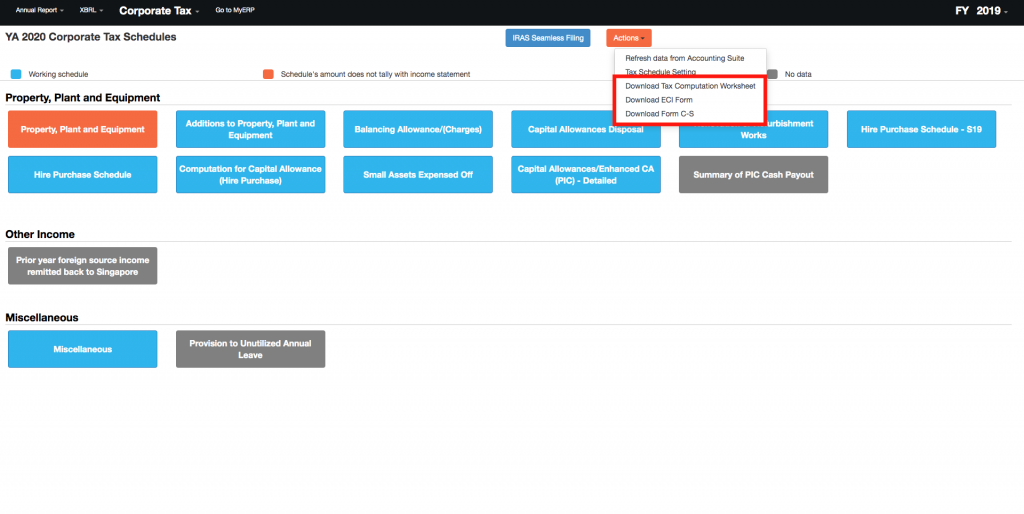

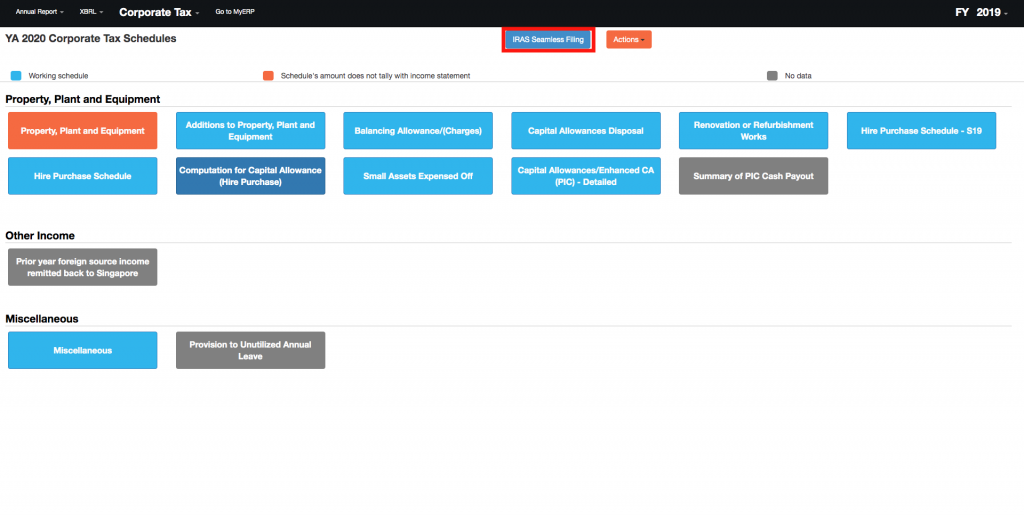

- Click on IRAS Seamless Filing to submit the document directly through the system

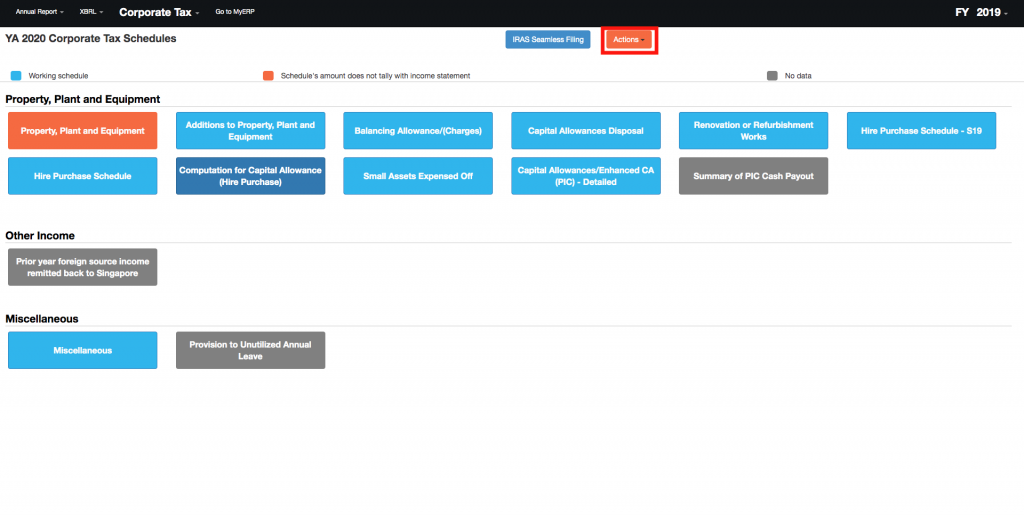

- For manual submission, click on Action

- Choose either of the reports downloaded below:

-

- Download tax computation worksheet

- Download form C-S

- Download ECI form

-

Note* Those boxes are for the numbers used for Corporate Tax. The ones in BLUE are numbers or data that are corrected or balanced while the ones in ORANGE are numbers that have errors or are not balanced.

What’s Next

Generate form IR8A and/or IR8S to report your employee earnings here.