Introduction

This feature will allow you to depreciate the fixed assets that you have recorded or imported.

Businesses will usually depreciate their fixed assets for not just accounting but also tax purposes.

For example, this allows businesses to take a tax deduction for the cost of the asset, which will reduce taxable income.

Before you begin

The system will have a computation of the fixed asset.

Ensure that you review this computation before proceeding.

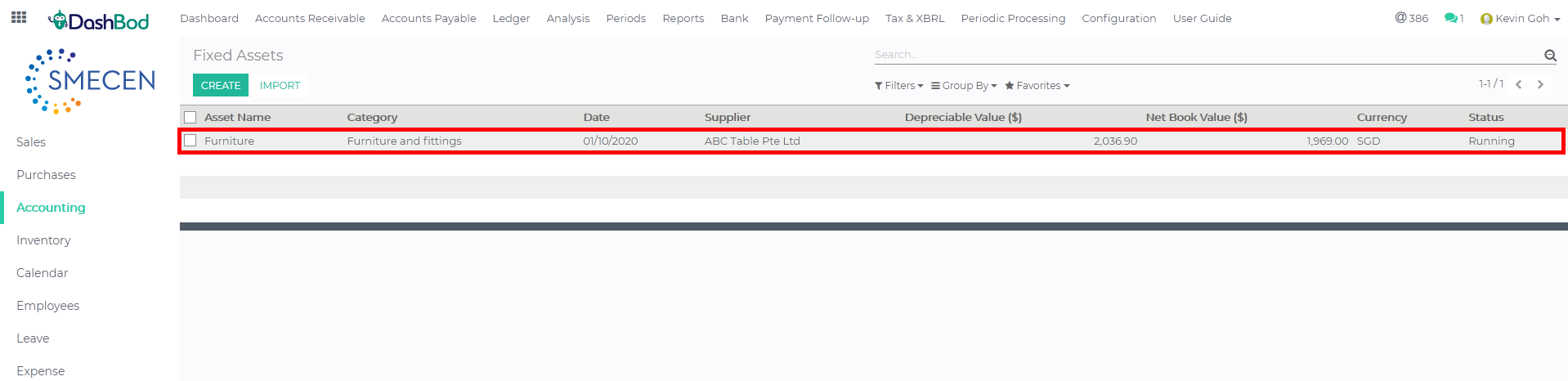

Navigating to your Fixed Assets page

1. Click on Accounting at the left panel (Red Box)

2. Click on Ledger at the top bar (Blue Box)

3. Click on Fixed Assets (Green Box)

4. Select the Fixed Asset you want to depreciate (Red Box)

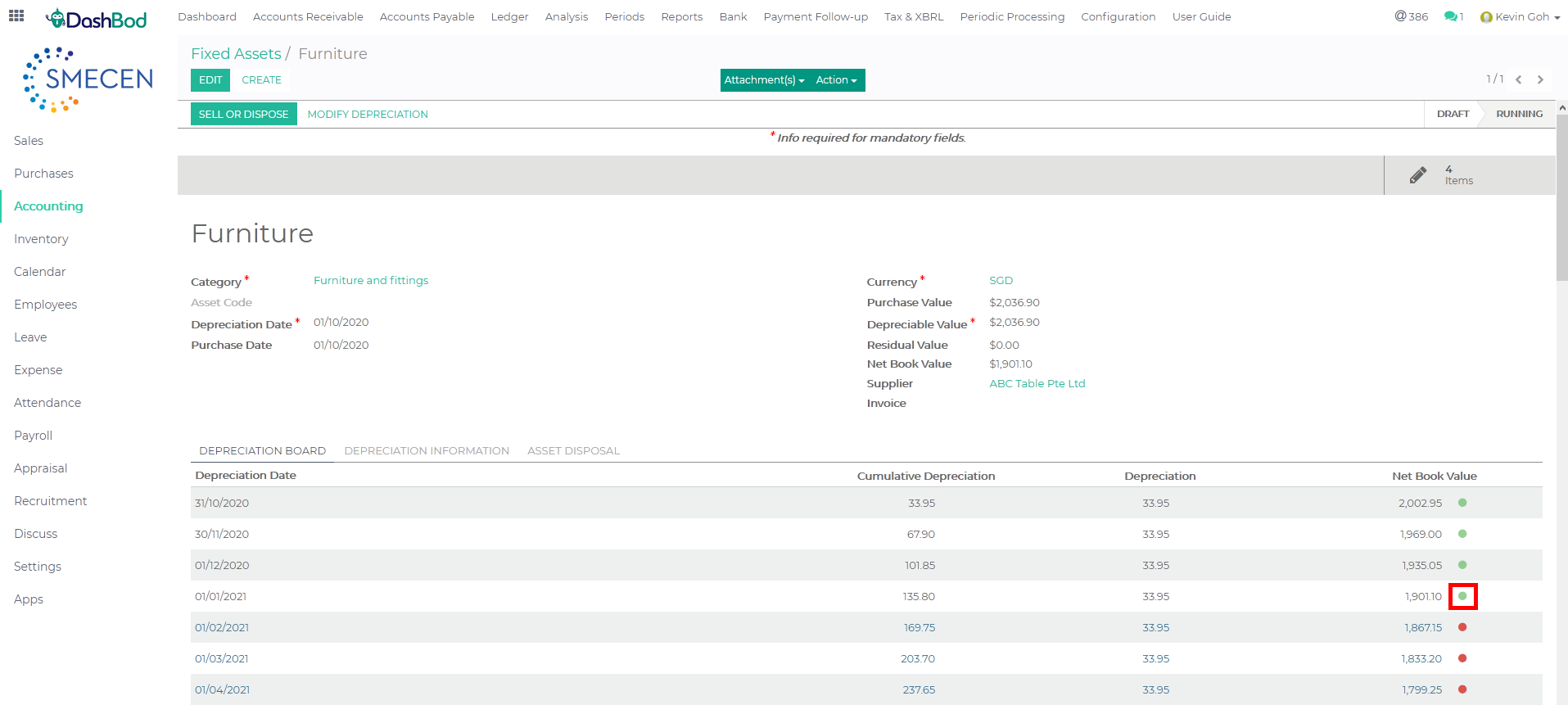

5. Select the red dot ![]() (Red Box)

(Red Box)

Activating the depreciation for your Fixed Asset

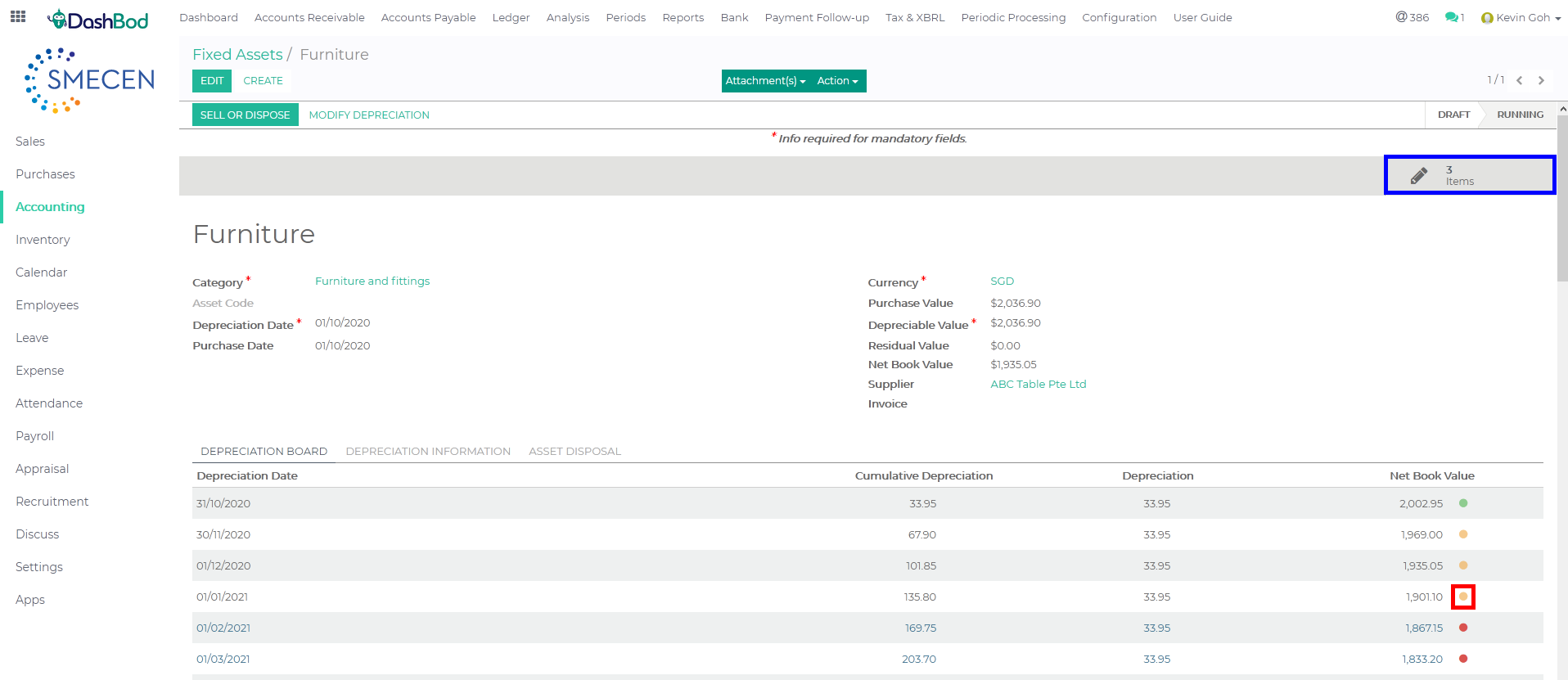

6. Once the dot changes to orange ![]() (Red Box)

(Red Box)

7. Click the 3 Items ![]() icon (Blue Box)

icon (Blue Box)

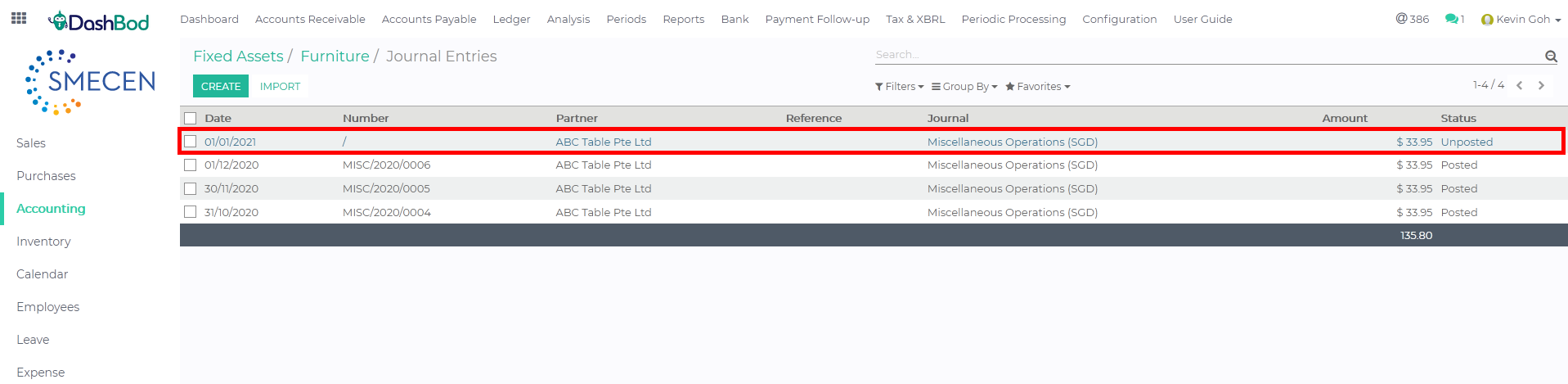

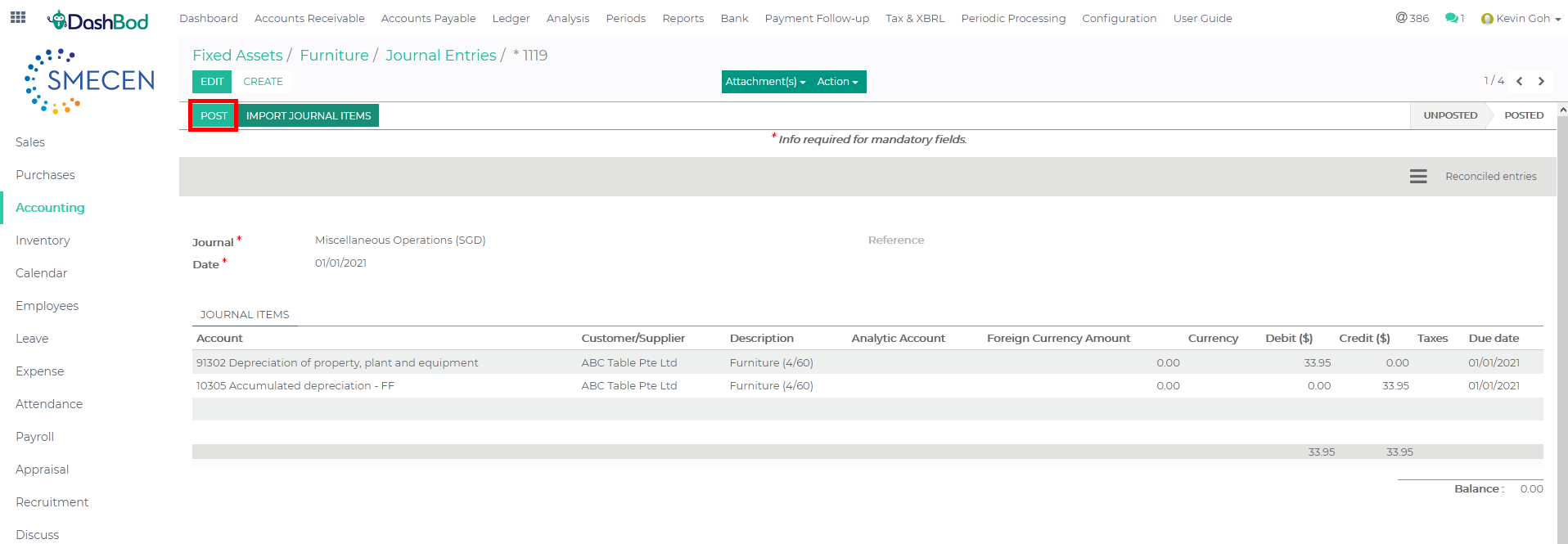

Posting your Fixed Asset

8. Select the Journal Entry to post your Fixed Asset (Red Box)

9. Click Post (Red Box)

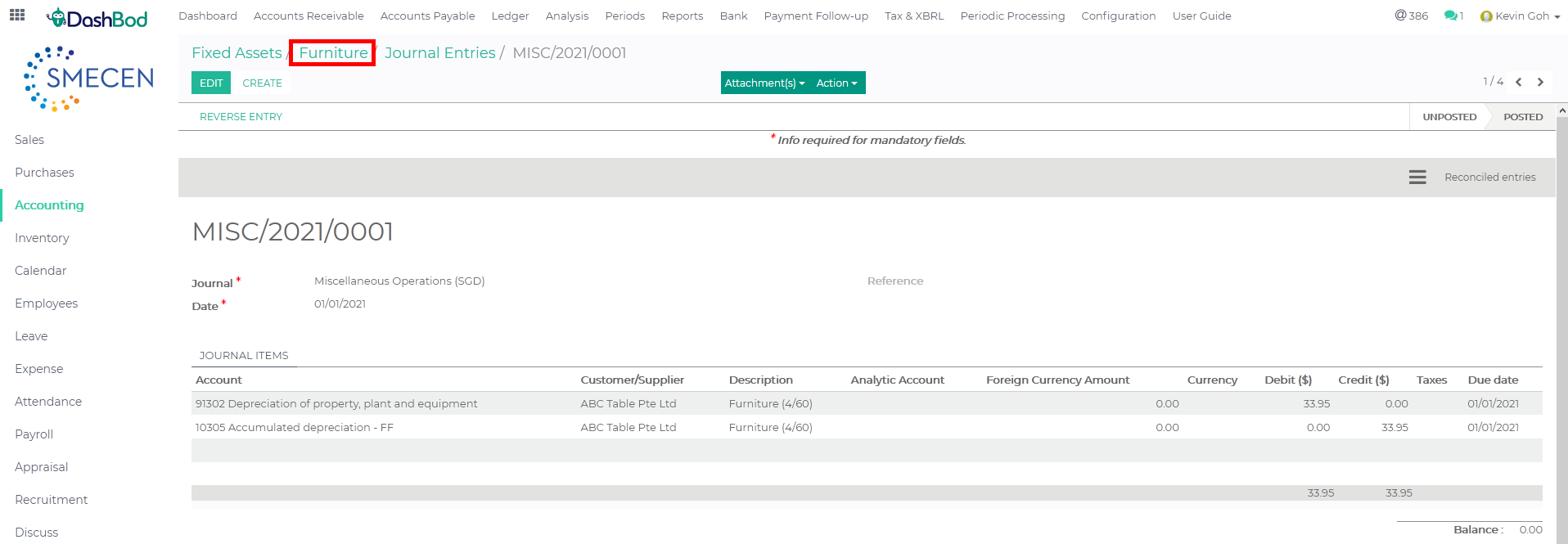

Checking your Fixed Asset

10. Click on Furniture (Red Box)

11. Notice the dot has changed to green dot ![]() (Red Box)

(Red Box)

Whats Next

You may be interested in how to Close a Financial Year.