Introduction

A journal entry is the first step in the accounting cycle. It is used to record business transactions in a business’s accounting records. As you will see in the guide below, journal entries are usually recorded in the general ledger.

A journal will record all financial transactions and entries require both a credit and a debit to be completed.

Before you begin

Ensure that you:

Understand what the transaction is for e.g. Bank charge, Adjustments

Know whether you want to debit or credit to a certain chart of accounts.

Navigating to your Journal Entries page

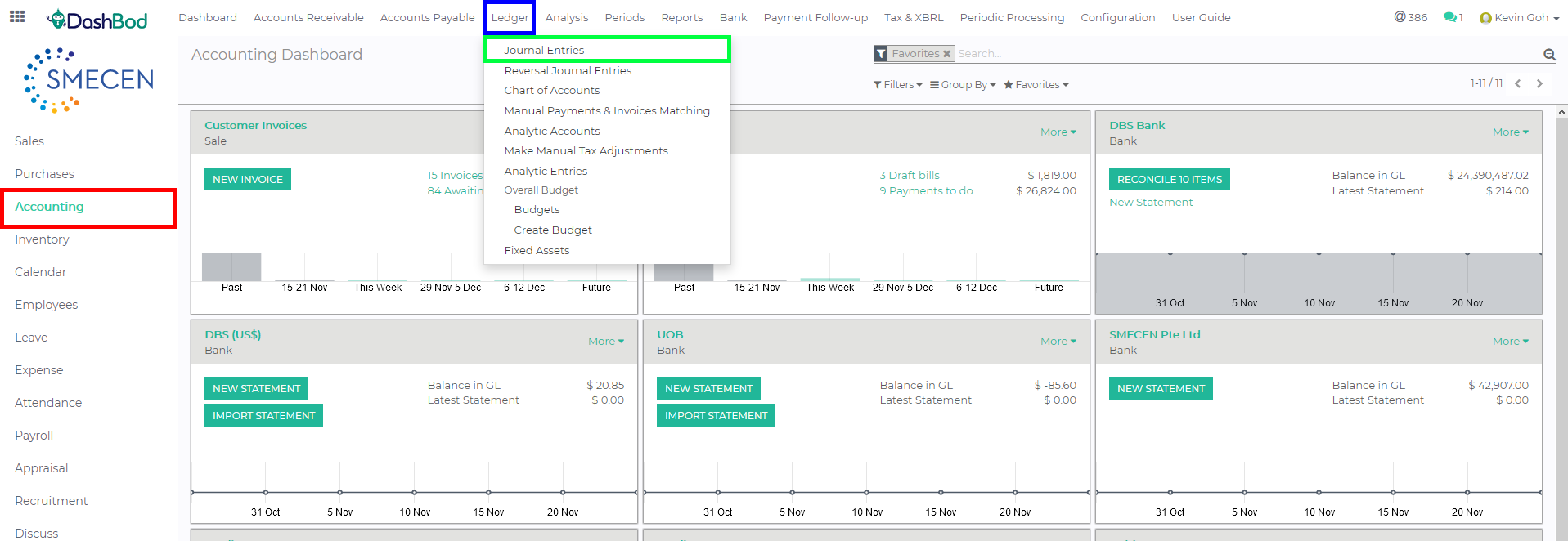

1. Click on Accounting at the left panel (Red Box)

2. Click on Ledger at the top bar (Blue Box)

3. Click on Journal Entries (Green Box)

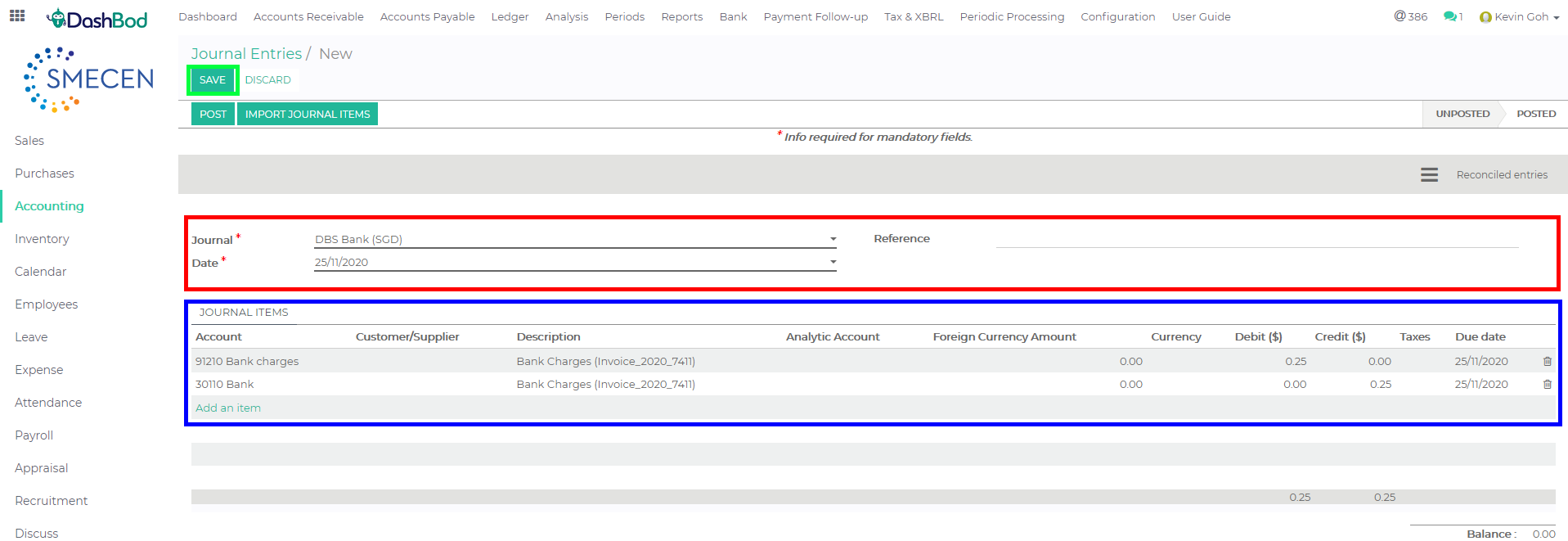

4. Click Create

5. Fill in the following fields (Red Box)

-

- Select the Journal type

- Select the Date

- Enter the Reference

Creating your Journal Entry

6. Enter the Journal Items (Blue Box)

-

- Enter the Account (Chart of Account)

- Enter the Description (A description for this transaction)

- Enter the Analytic Account (Optional)

- Enter the Foreign Currency Amount

- Select the Currency type

- Enter the Debit amount

- Enter the Credit amount

- Select the Taxes (If you do not select your ‘Taxes’, it will not be accounted for inside your GST Form 5)

- Select the Due date

7. Click Save once done (Green Box)

Note: Please do note that your debit and credit amount must balance to save this

Posting your Journal Entry

8. Click Post (Red Box)

What’s Next

Now that you are done, you may proceed to generate a On-screen Report.