Introduction

Submitting CPF is a must-do for every company that hires Singaporeans or PR in Singapore. Submissions to CPF can be typed into the CPF website. Using DashBod, our customers only process the payroll every month and DashBod generates a CPF file for you to upload to CPF. This article shows you how to do that step by step.

Before you begin

You must have already processed a single payslip or a batch of payslips for the DashBod to have generated a CPF .txt file for upload. You may need to process expense claims or add bonuses, commissions.

Navigating to CPF Submission page

1. Click on Payroll at the left panel (Red Box)

2. Click on Reports at the top bar (Blue Box)

3. Click on CPF Submission (Green Box)

4. Click Create

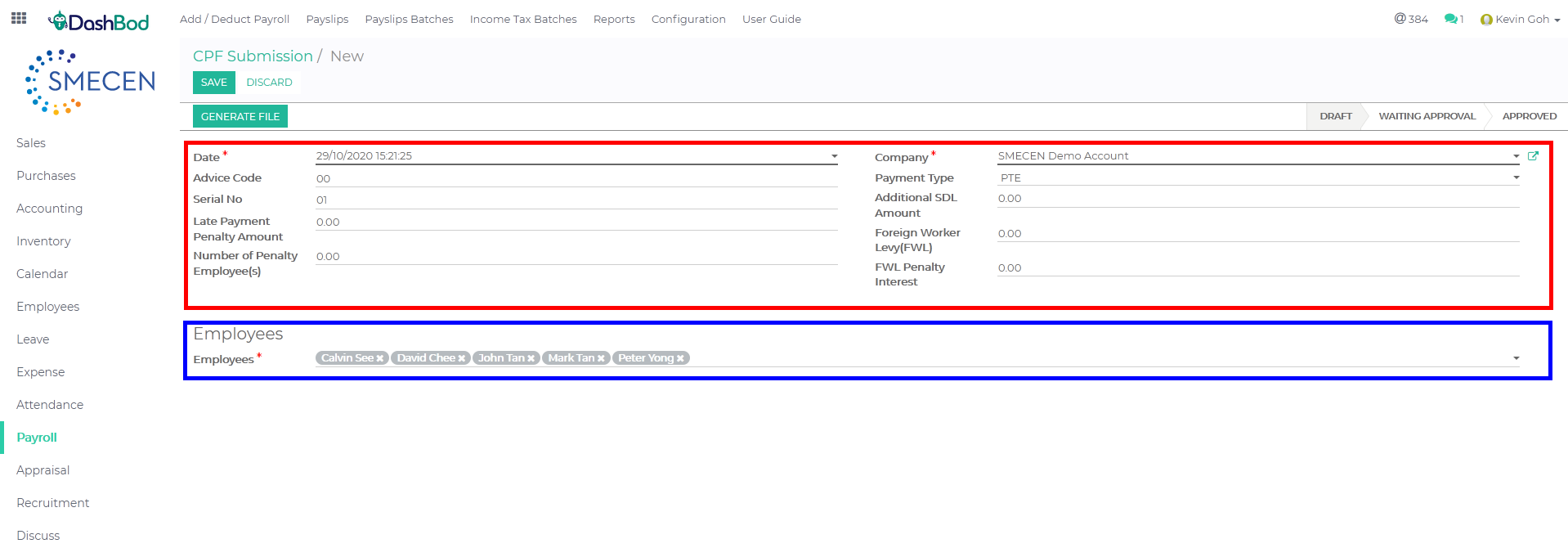

5. Fill in the necessary details (Red Box)

-

- Date* – (Date of the file)

- Advice Code – (Advice code should always be ’01’ except when more than 1 CPF document was submitted for the month)

- Serial No. – (CPF Submission Number (CSN) is the number you use to transact with CPF board)

- Late Payment / Penalty Amount (Fill in if any) (Optional)

- Number of Penalty Employee(s) (Fill in if any) (Optional)

- Company*

- Payment Type – (CPF Submission Number (CSN) is the number you use to transact with CPF board)

- Additional SDL Amount (Fill in if any) (Optional)

- Foreign Worker Levy (FWL) (Fill in if any) (Optional)

- FWL Penalty Interest (Fill in if any) (Optional)

6. Select your Employee* (Blue Box)

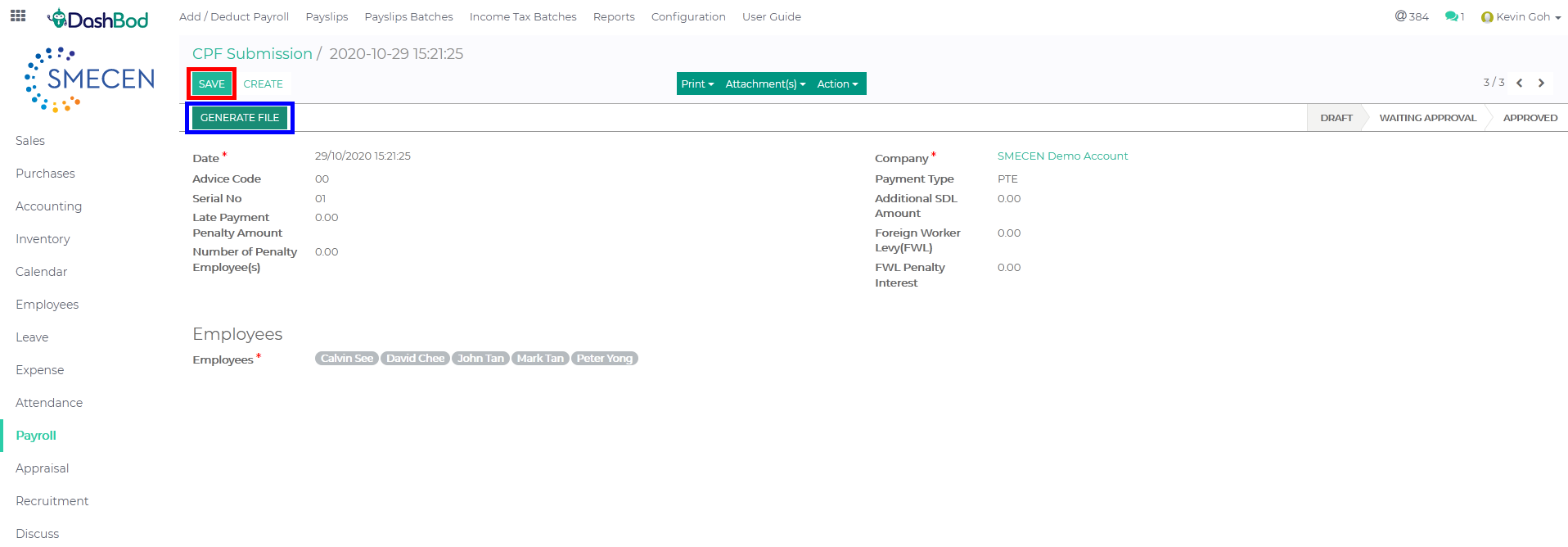

7. Click Save

8. Click Generate File once done

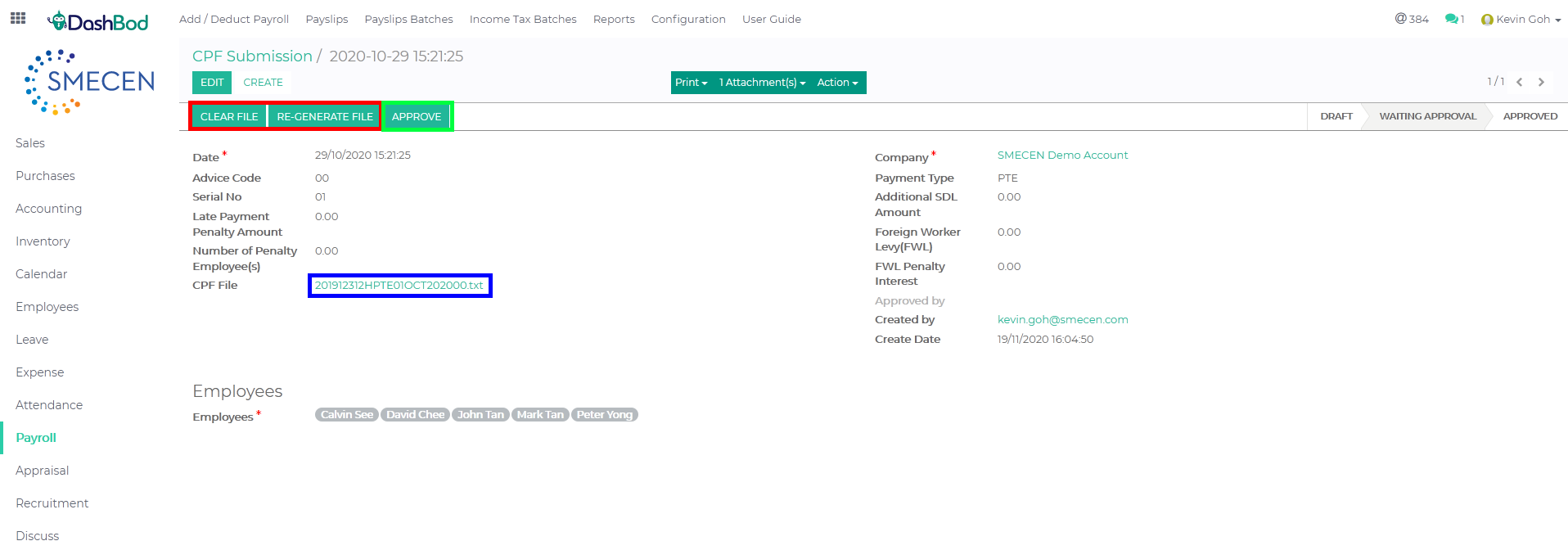

9. Click on Clear file if you need to do any editing payroll (Optional) (Red Box)

10. Click on Re-Generate File if you need to re-generate the CPF e-submission file (Optional) (Red Box)

11. Click on CPF file .txt file to download for submission (Blue Box)

12. Click Approve once you have e-submitted the file to CPF board (Green Box)

What’s Next

You may also make use of DashBod’s IR8A e-submission.

DashBod will be able to generate a .txt file for submission to IRAS.