Introduction

Fixed assets should be recorded accurately since the information such as cost and useful life may subsequently affect its monthly depreciation amount calculated by the system.

Before you begin

This guide shows you how to record a single fixed asset.

If you are looking to record multiple fixed assets, click here.

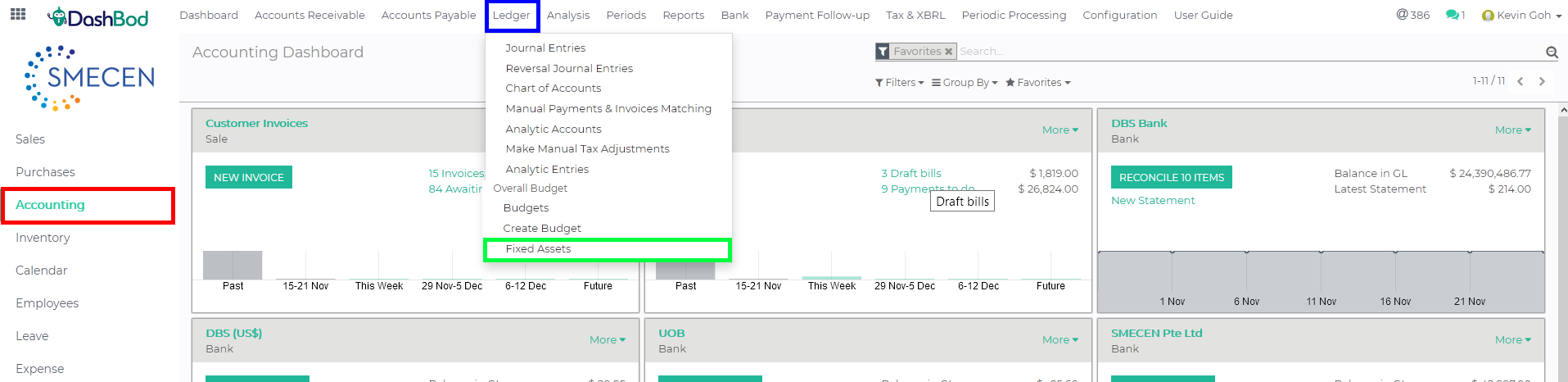

Navigating to your Fixed Assets page

1. Click on Accounting at the left panel (Red Box)

2. Click on Ledger at the top bar (Blue Box)

3. Click on Fixed Assets (Green Box)

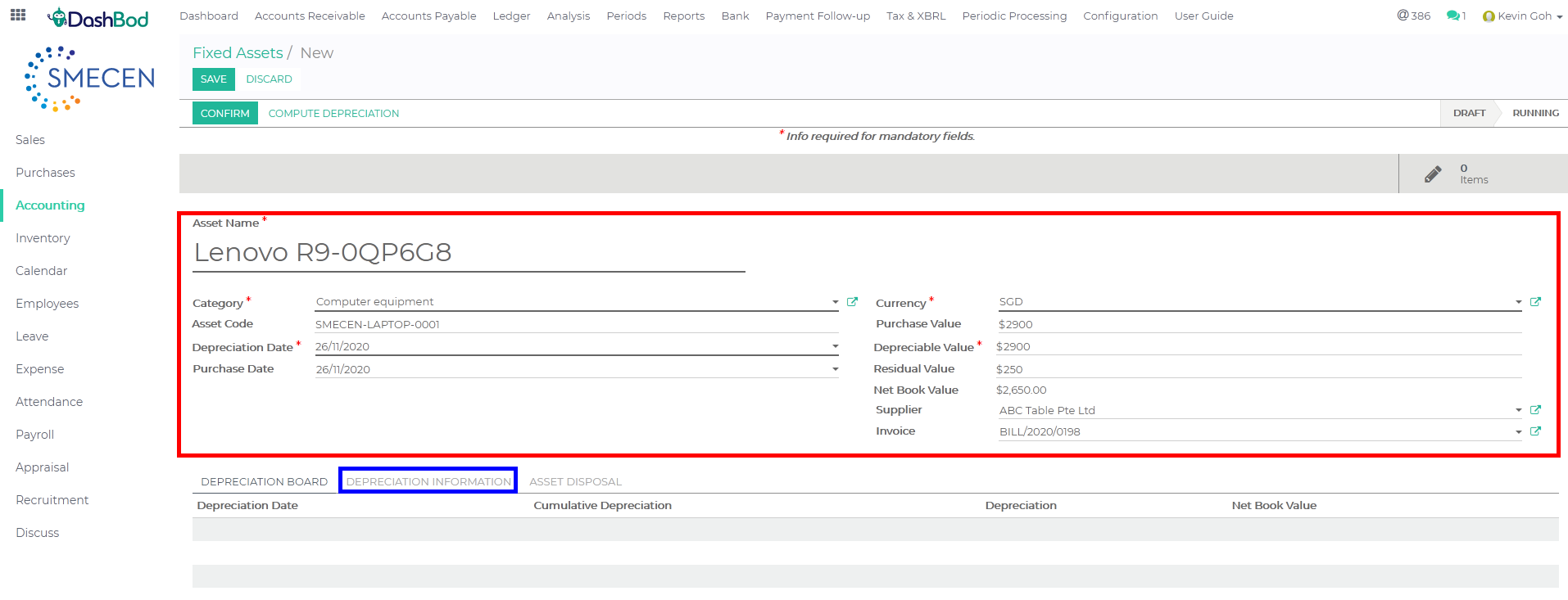

Creating a Fixed Asset

4. Click Create

5. Fill in the following fields (Red Box)

-

- Asset Name

- Category – (Asset category)

- Asset Code – (ID number for your Asset)

- Depreciation Date

- Purchase Date

- Currency – (Currency used to purchase this Asset)

- Purchase Value – (Cost of your Fixed Asset)

- Depreciable Value – (Value left to depreciate)

- Residual Value – (Scrap value – Cost of Disposal value = Residual Value)

- Supplier – (Supplier’s Name)

- Invoice – (Supplier Bill Number)

6. Click Depreciation Information tab for other settings (Blue Box)

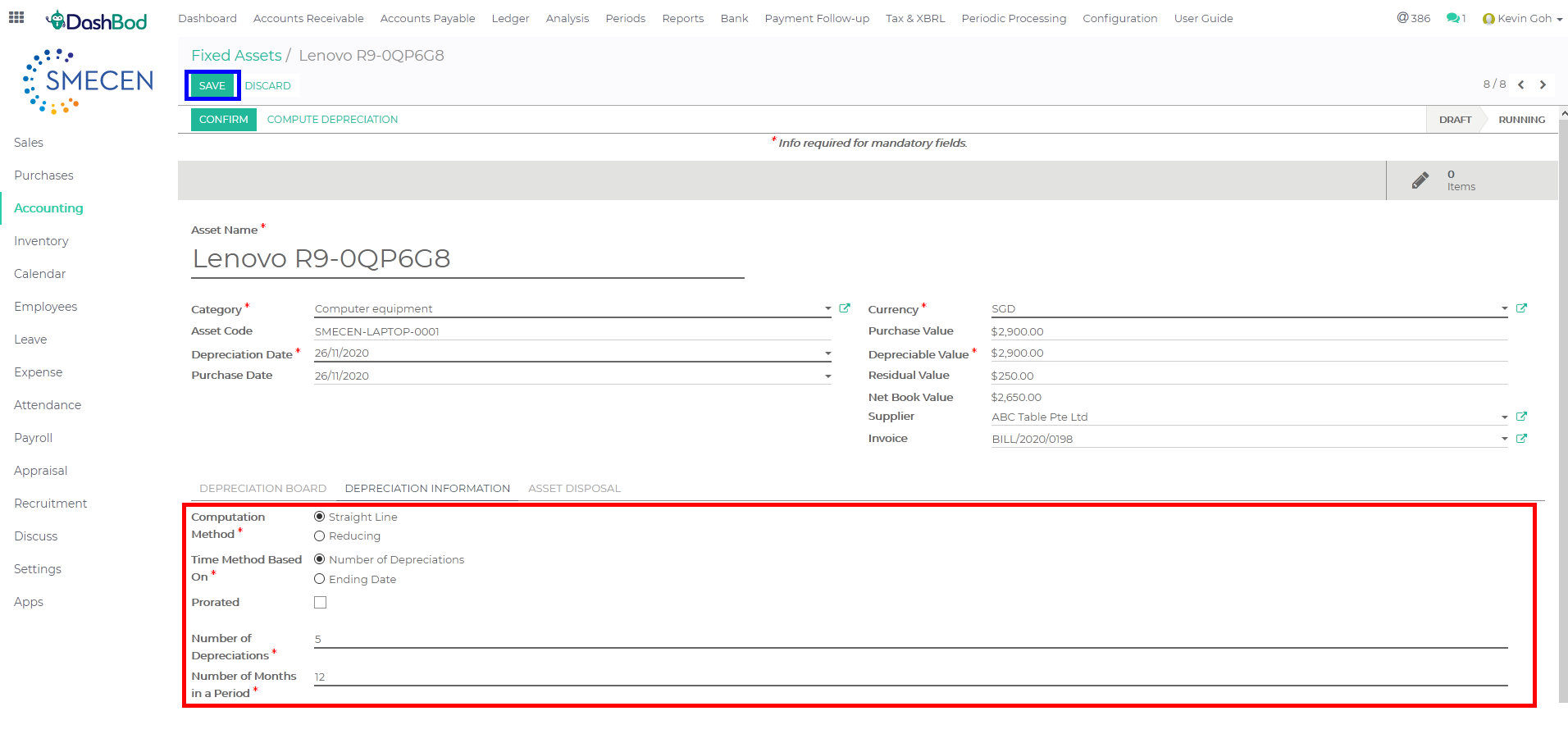

Advance setting for your Fixed Asset

7. Fill up the following fields (Red Box)

-

- Computation Method

- Time Method Base on

- Prorated

- Number of Depreciations

- Number of Months in a Period (1 = Yearly and 12 means Monthly)

8. Click Save (Blue Box)

9. Click on Depreciation Board tab (Red Box)

10. Check the computed depreciation table (Blue Box)

11. Click Confirm once done (Green Box)

What’s Next

After recording, you may proceed to start computing your depreciations of your Fixed Assets and post your assets.