Introduction

Bank Reconciliation is a basic feature in any accounting system. Every business needs to match their bank transactions against transactions in your accounting books. These transactions includes payment for rental, bills, vendors, suppliers and income/revenue from customers.

When all transactions are matched each year, then books can be prepared and filed. DashBod recommends that business with less than 200 transactions a year reconcile their books a minimum of twice a year and companies with more than a 100 transactions a month to reconcile their books monthly.

The video below complements the guide on the steps to take using DashBod’s Auto-Matching Bank Reconciliation.

Before you begin

If you have many transactions to reconcile, try the auto-matching bank reconciliation feature first to reduce the amount of matching work you need to do.

If you use OCBC Business Banking, connect your business banking account to DashBod before you start.

Otherwise, import your bank statements into the system before you begin reconciliation.

Navigating to Manual Bank Reconciliation page

1. Click on Accounting at the side panel (Red Box)

2. Click on Bank at the top bar (Blue Box)

3. Click on Reconcile Bank Accounts (Green Box)

Preparing the transaction

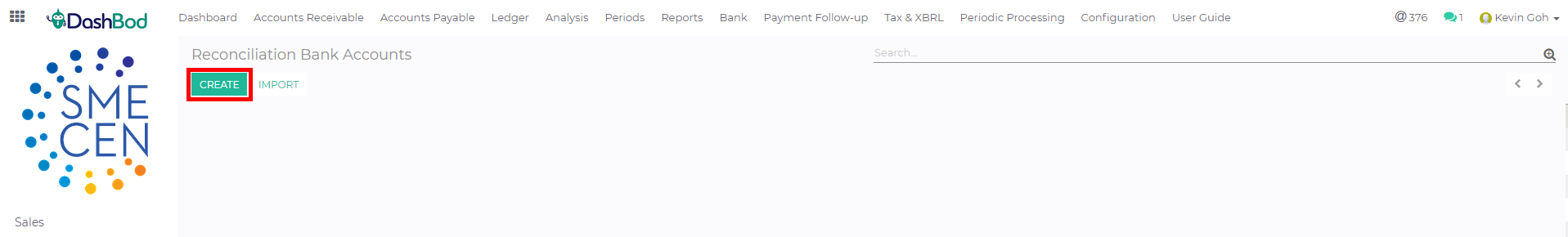

4. Click Create

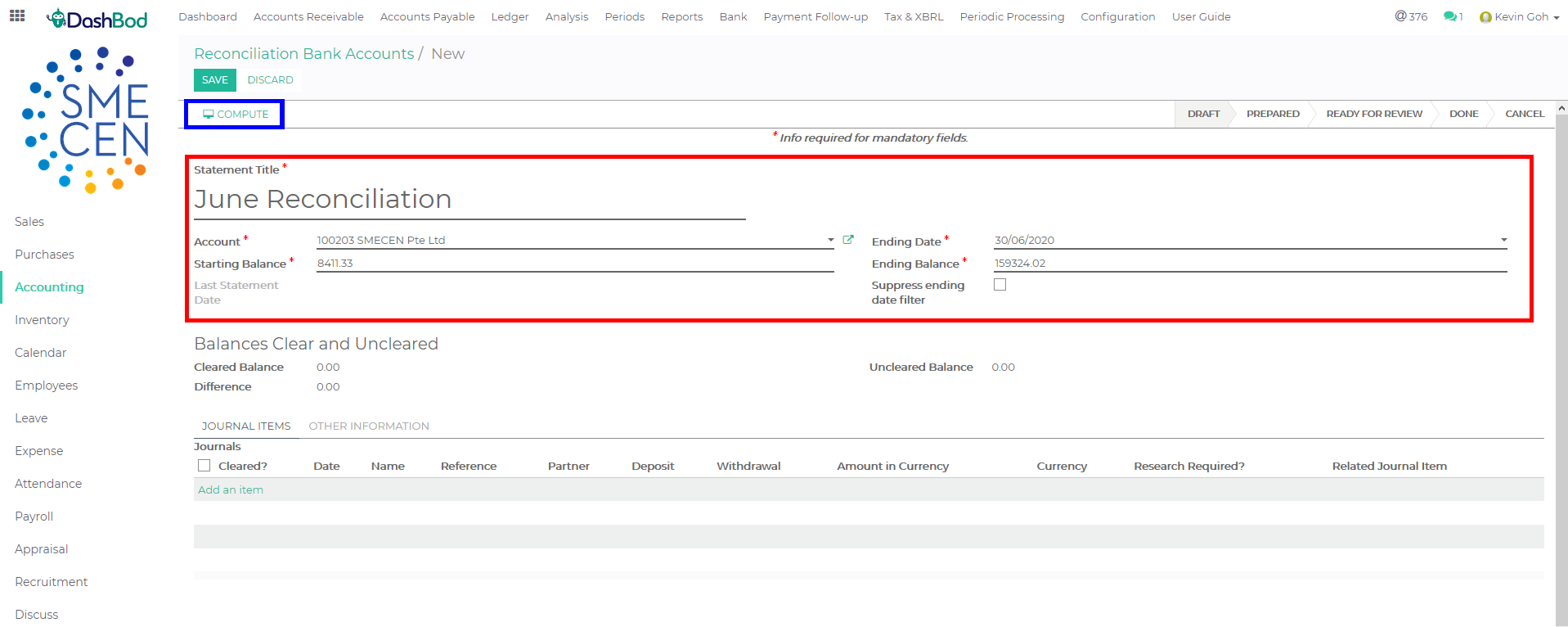

5. Fill in the details (Red Box)

-

- Statement Title (Title of your bank reconciliation Example: June Statement)

- Account (Select which bank or cash account you are doing bank reconciliation?)

- Starting Balance (Starting of the month or period balance left in the company’s bank account)

- Ending Date (Ending date of the reconciliation)

- Ending Balance (Ending of the month or period balance left in the company’s bank account)

- Suppress ending date filter (Check this only if you have a transaction after the ending date)

6. Click Compute (Blue Box)

Matching system transaction against statement

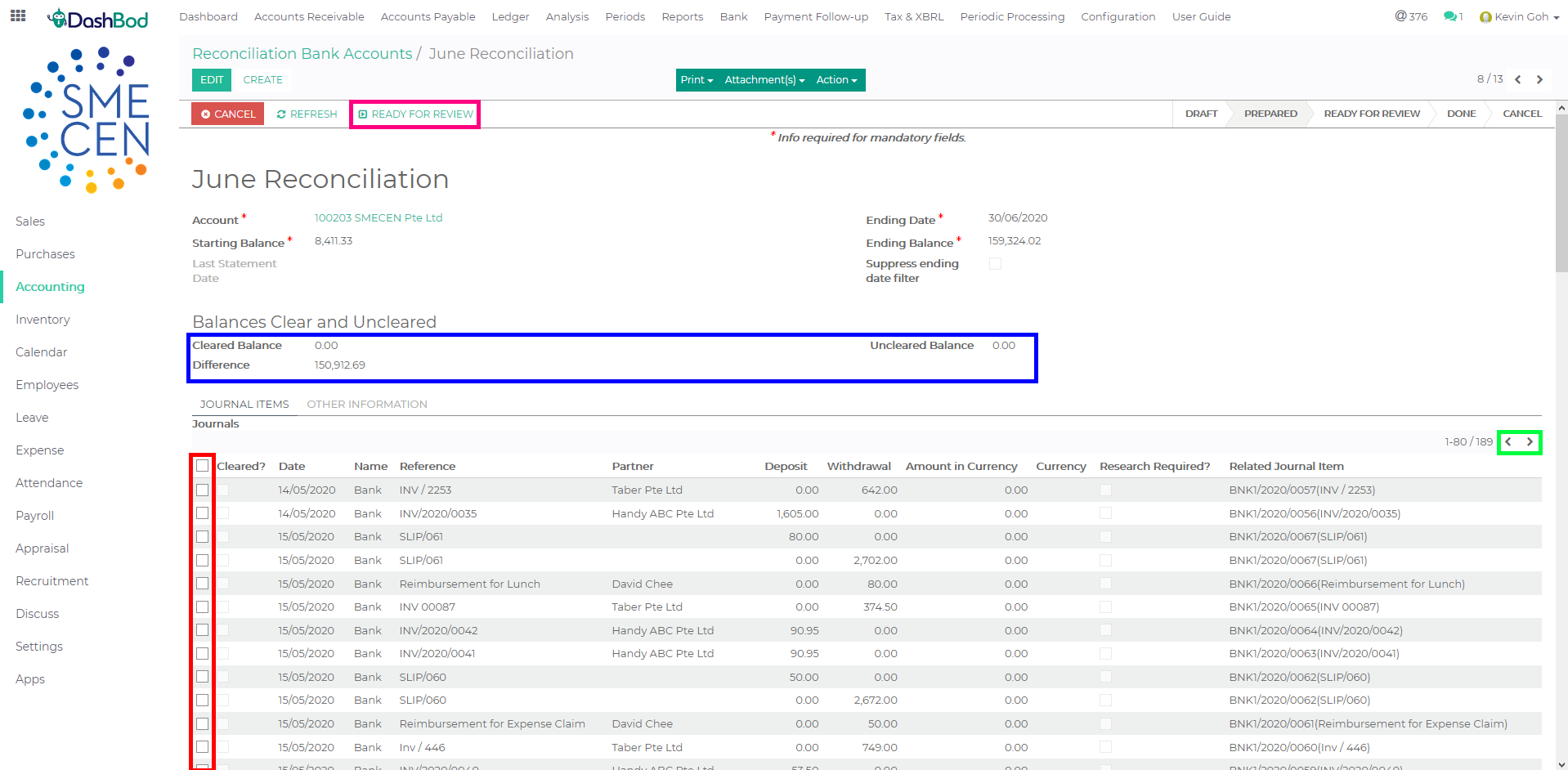

7. Click the check box to reconcile (Red Box)

8. Balances Clear and Uncleared shows you how much are you short and the differences. (Blue Box)

9. Click left and right arrow for next page if needed (Green Box)

10. Click Ready for Review once you complete your reconciliation (Pink Box)

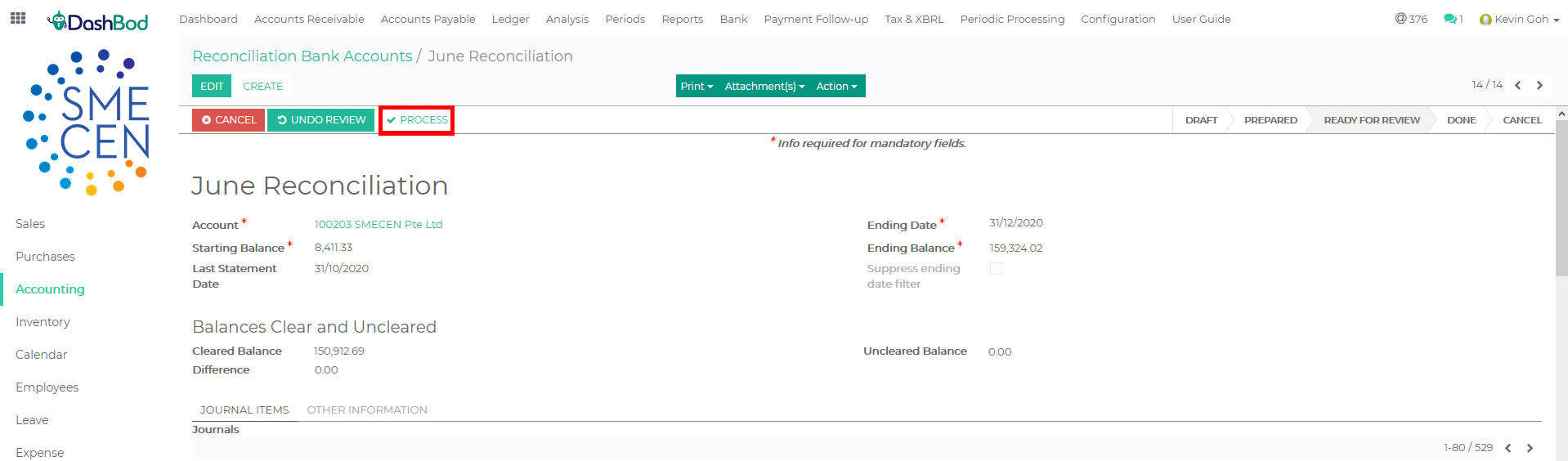

7. Click Process (Red Box)

After this you are done! You successfully finished your bank reconciliation

What’s Next

Now that you have reconciled the bank transactions against your invoices and bills, look at the outstanding bank transactions and create invoices or enter bills to fully reconcile your books.