Introduction

A fixed asset configuration helps you classify all your fixed assets. You can classify an item as IT Equipment or specify it as Servers, Laptops, Properties, Renovations.

These fixed asset configuration will then allow you to set the yearly or monthly depreciation such as straight line and reducing depreciation.

Before you begin

Know what are the different types of fixed assets you have so you can properly classify them and make sure you cover them all during the set up.

If you are adding a new fixed asset type, you can do so singularly mid year.

How it Works

- Go to your Asset Types

-

- Click on Accounting at the side panel (Red Box)

- Click on Configuration at the top Bar (Blue Box)

- Select on Asset Types (Green Box)

2. Click Create

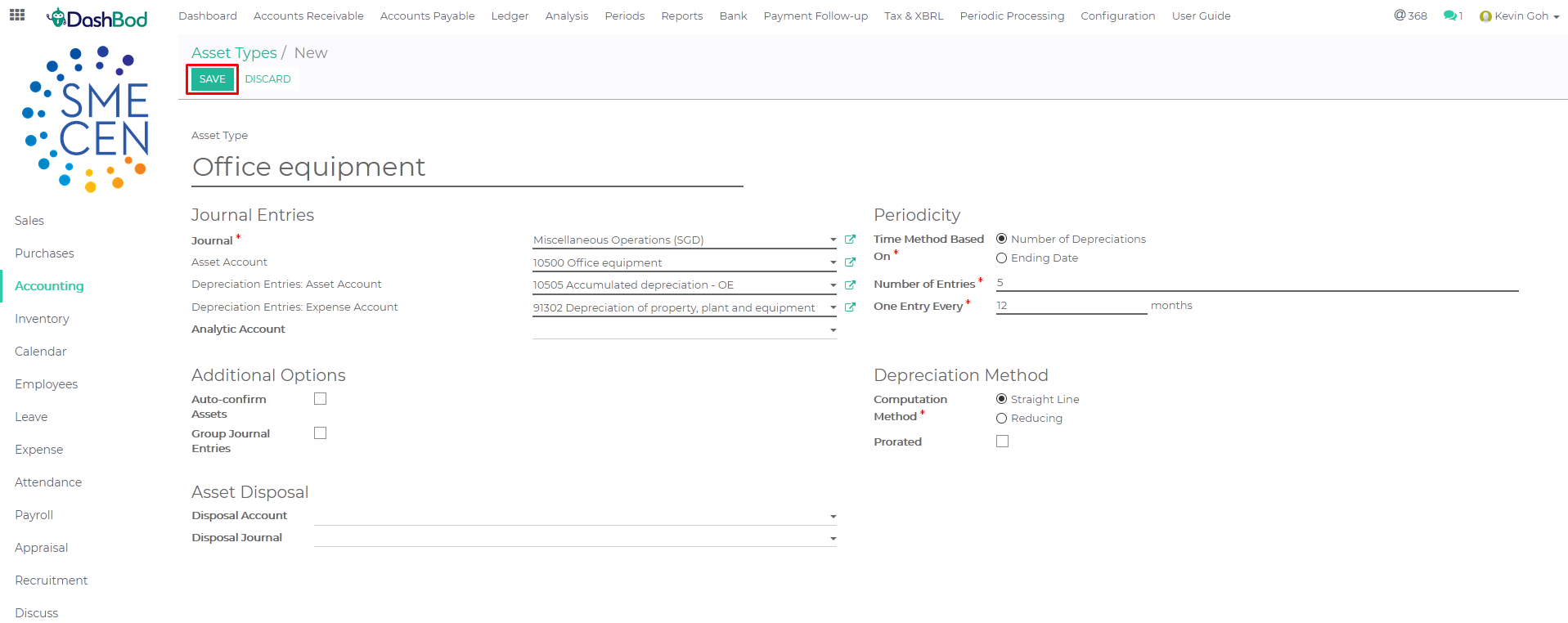

3. Fill in the necessary information and select the appropriate asset type settings.

-

-

- Asset Type (Red Box)

- Journal Entries (Blue Box)

- Additional Options (Green Box)

- Asset Disposal (Purple Box)

- Periodicity (Pink Box)

- Depreciation Method (Black Box)

-

4. Click on Save once completed (Red Box)

There is a total of 10 asset types to create, repeat steps 1 to 4 above to create other asset types.

- Office equipment

- Motor vehicles

- Furniture and fittings

- Computer equipment

- Leasehold Property

- Leasehold Improvements

- Plant and machinery

- Renovation

- Signage

- Investment Property

**Do note that you will need to create all of the Asset types listed above before using the Fixed Asset function in DashBod.

What’s Next

You may now create or Import your Fixed Asset into the system. The system will be able to calculate for you the depreciating value of your assets automatically.