Introduction

This article covers how to add ad-hoc Payment Items into an Employee’s Payslip, e.g., annual wage supplement, bonus, commission, incentive, part-time employee, advance and loan.

Before you begin

You will have to create both Employee Profile and EMP Terms (Employment Terms) first before adding an ad-hoc Payment Item into their Payslip.

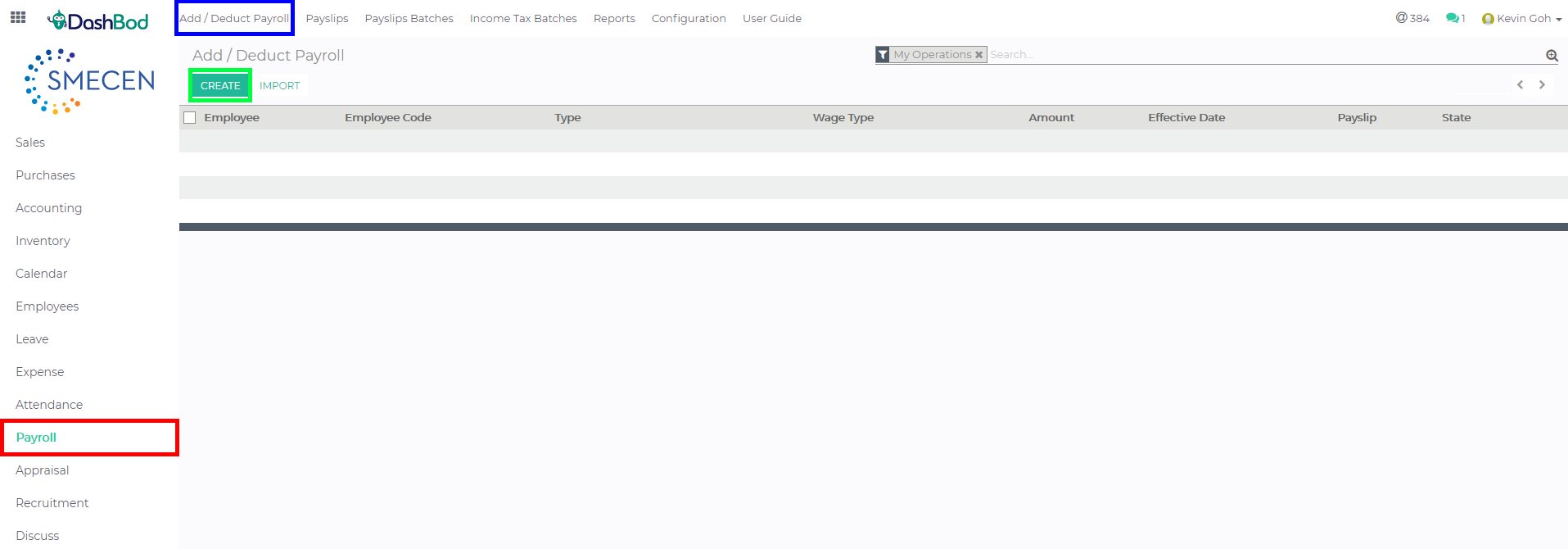

Navigating to your Add/Deduct Payroll page

1. Click on Payroll at the left panel (Red Box)

2. Click on Add/Deduct Payroll at the top bar (Blue Box)

3. Click Create (Green Box)

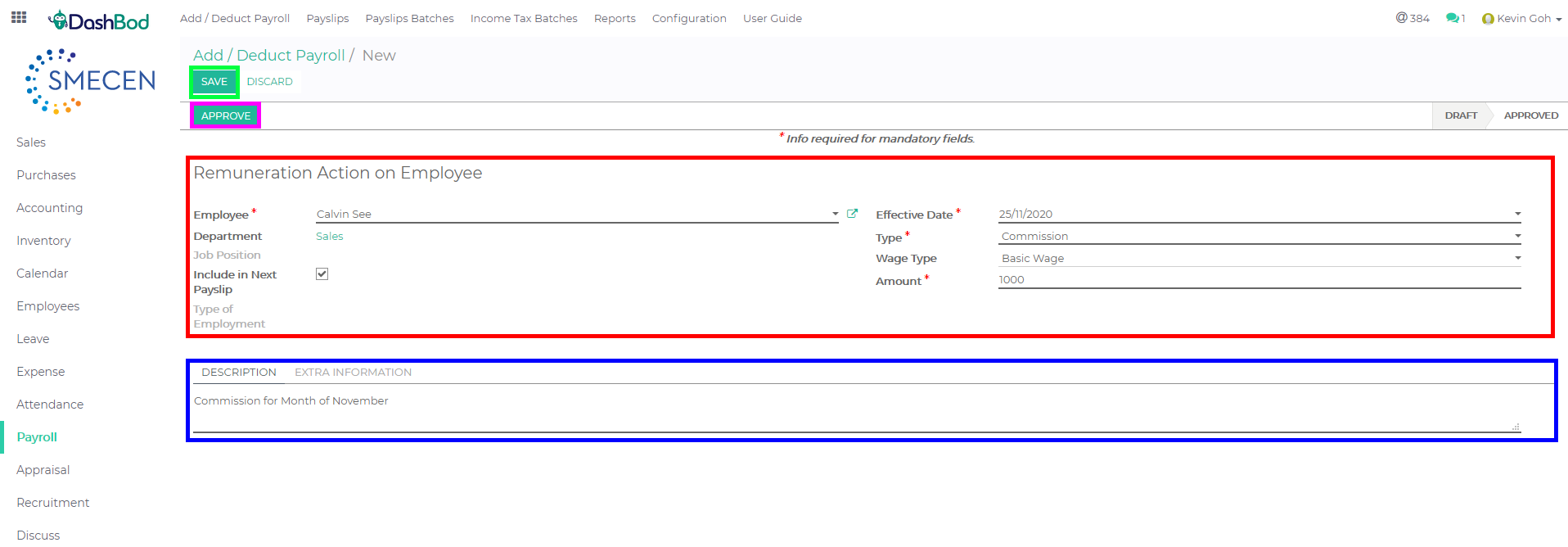

Add and Deduct details

4. Fill up the following fields (Red Box)

-

- Select the Employee

- Select the Effective Date

- Select the Type

- Select the Wage Type

- Enter the Amount

5. Enter additional remarks in the Description below (Blue Box)

6. Click Save (Green Box)

7. Click Approve once done (Pink Box)

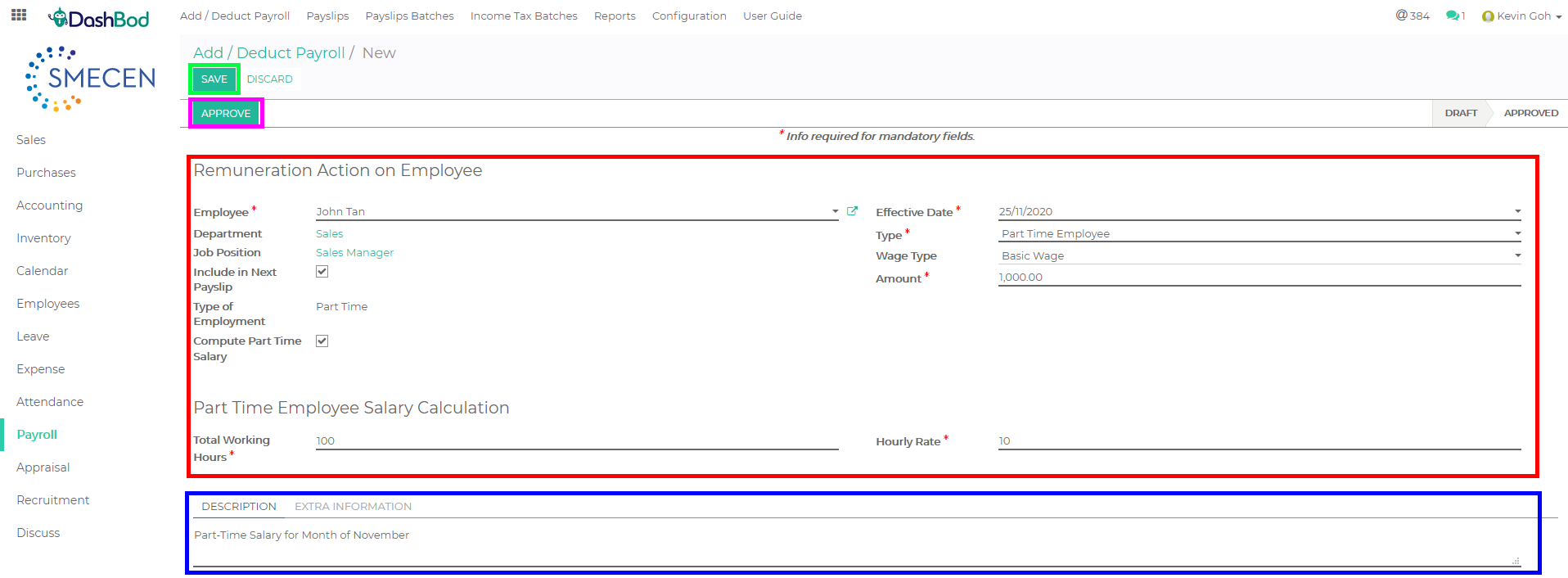

For Part Time Employee only

1. Fill up the follow fields (Red Box)

-

- Select the Employee

- Select the Effective Date

- Select the Type

- Select the Wage Type

2. Check the Compute Part Time Salary Box

3. Fill in the Total Working Hours & Hourly Rate

3. Enter additional remarks in the Description below (Blue Box)

4. Click Save (Green Box)

5. Click Approve once done (Pink Box)

Note: Please note that the Amount will be auto computed once you have finish entering this 2 fields.

What’s Next

Now that you’re done with adding an ad-hoc payment item into a payslip, you may want to take a look at preparing Expense Claims or generating an Employee’s Payslip.