Introduction

Every account has a code, name, nature/type and it helps accountants organise inbound and outbound transaction. There are 5 main categories of accounts: Assets, Liabilities, Equity, Revenue and Expenses.

Different industries and businesses have different ways of recognising income and expenses and hence need to customise their chart of accounts.

Dashbod has a preset chart of accounts and a new company can skip setting up the chart of accounts. However, you cannot change your chart of accounts mid year or after you do transactions. Dashbod algorithms will reject any changes attempted.

Before you begin

If you know what industry you are in and the kind of transactions you have, you can create a new chart of accounts to better classify your transactions.

If you require support or advice on chart of accounts and accounting codes, reach out to any of our accounting partners.

Short Introduction

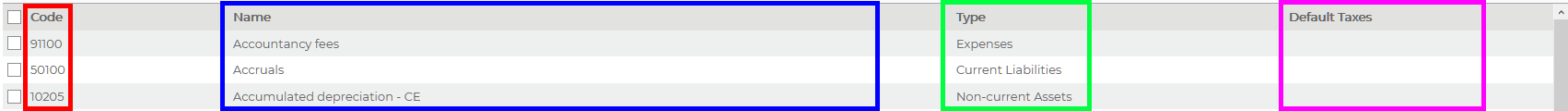

A default Chart of Accounts has 3 different important components.

- Code (Red Box)

- Name (Blue Box)

- Type (Green Box)

- Default Taxes (Optional) (Pink Box)

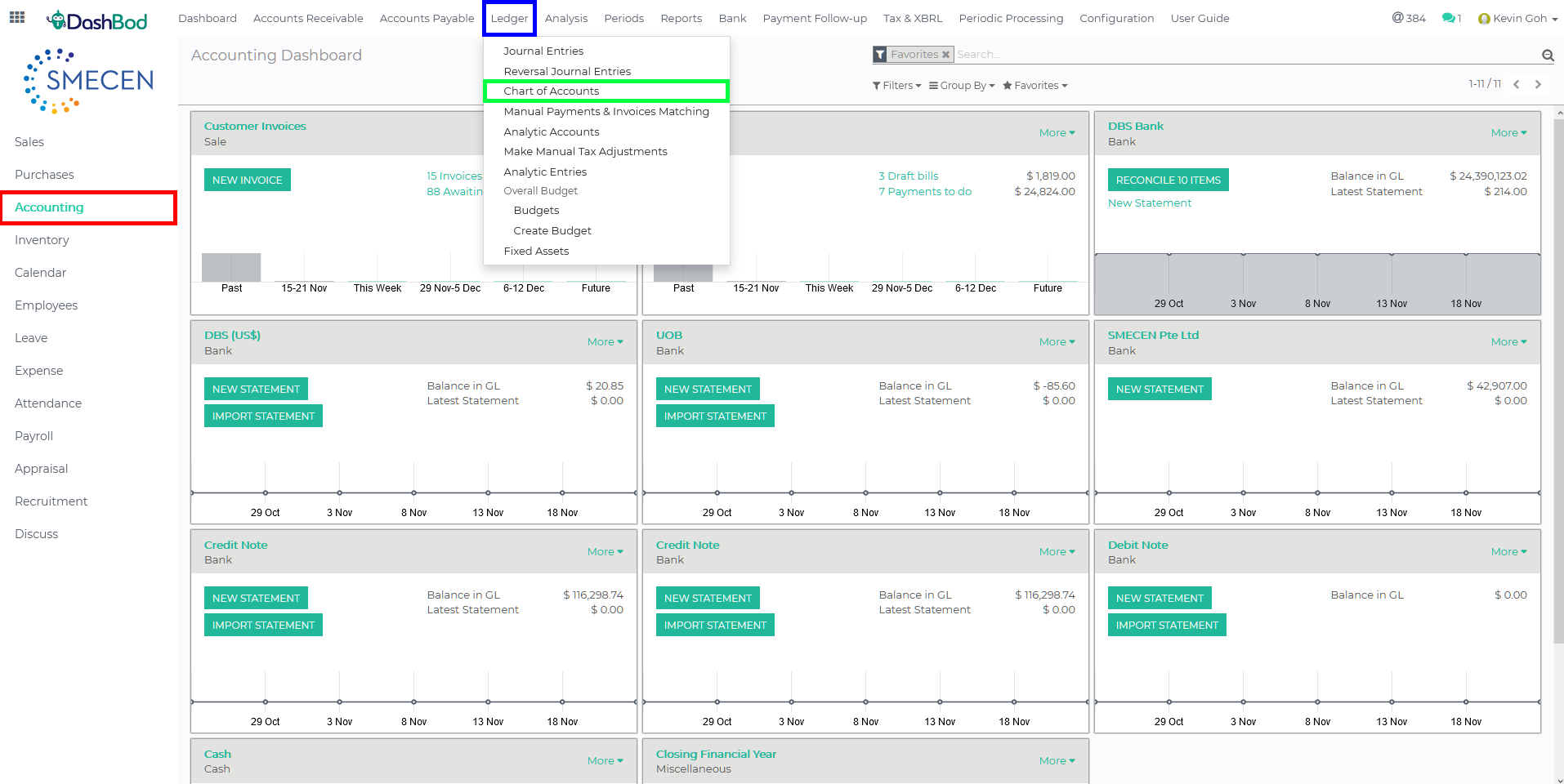

Navigating to your Chart of Accounts page

1. Click on Accounting at the left panel (Red Box)

2. Click on Ledger at the top bar (Blue Box)

3. Click on Chart of Accounts (Green Box)

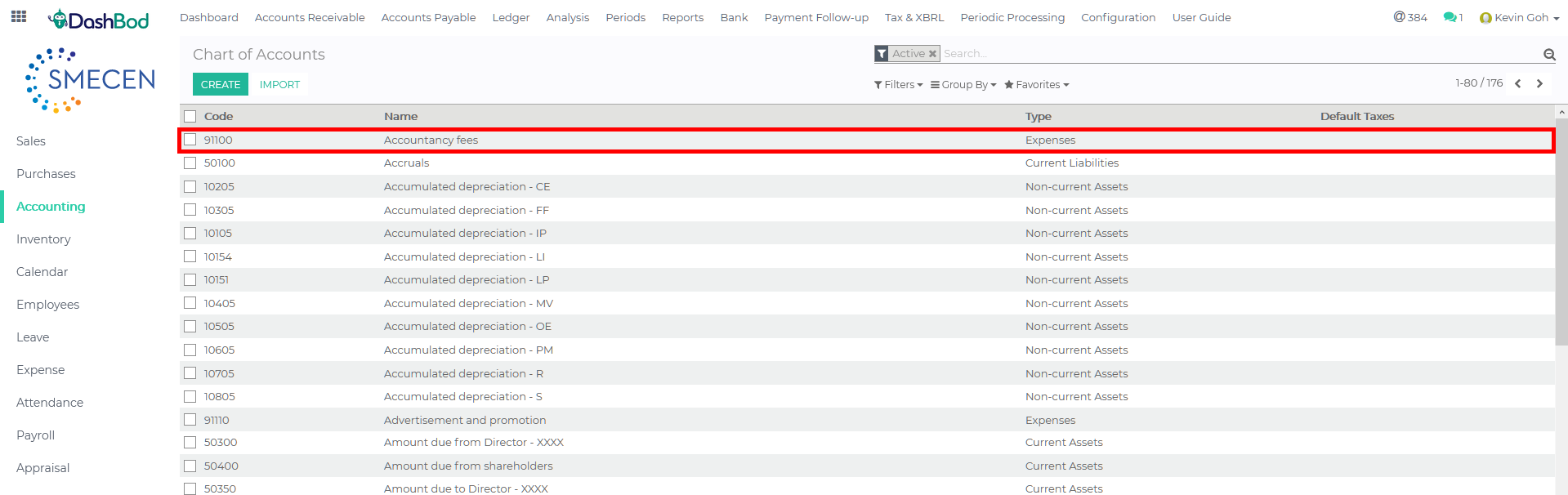

Duplicating the Chart of Accounts

4. Select a similar type of Chart of Accounts you are creating (Red Box)

(Example: If you are creating an Expense account look for Expense type Chart of Accounts)

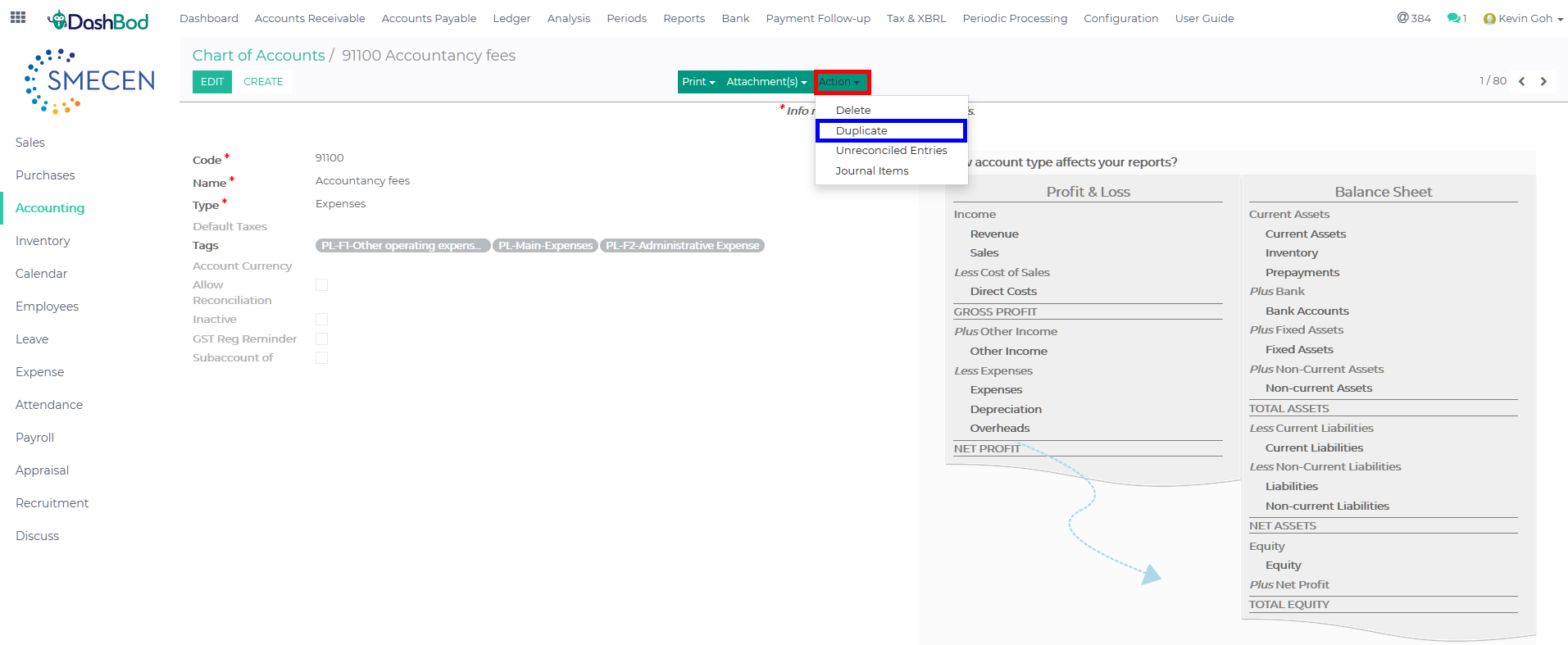

5. Click Action (Red Box)

6. Click Duplicate (Blue Box)

7. Amend the Code (Red Box)

8. Amend the Name (Blue Box)

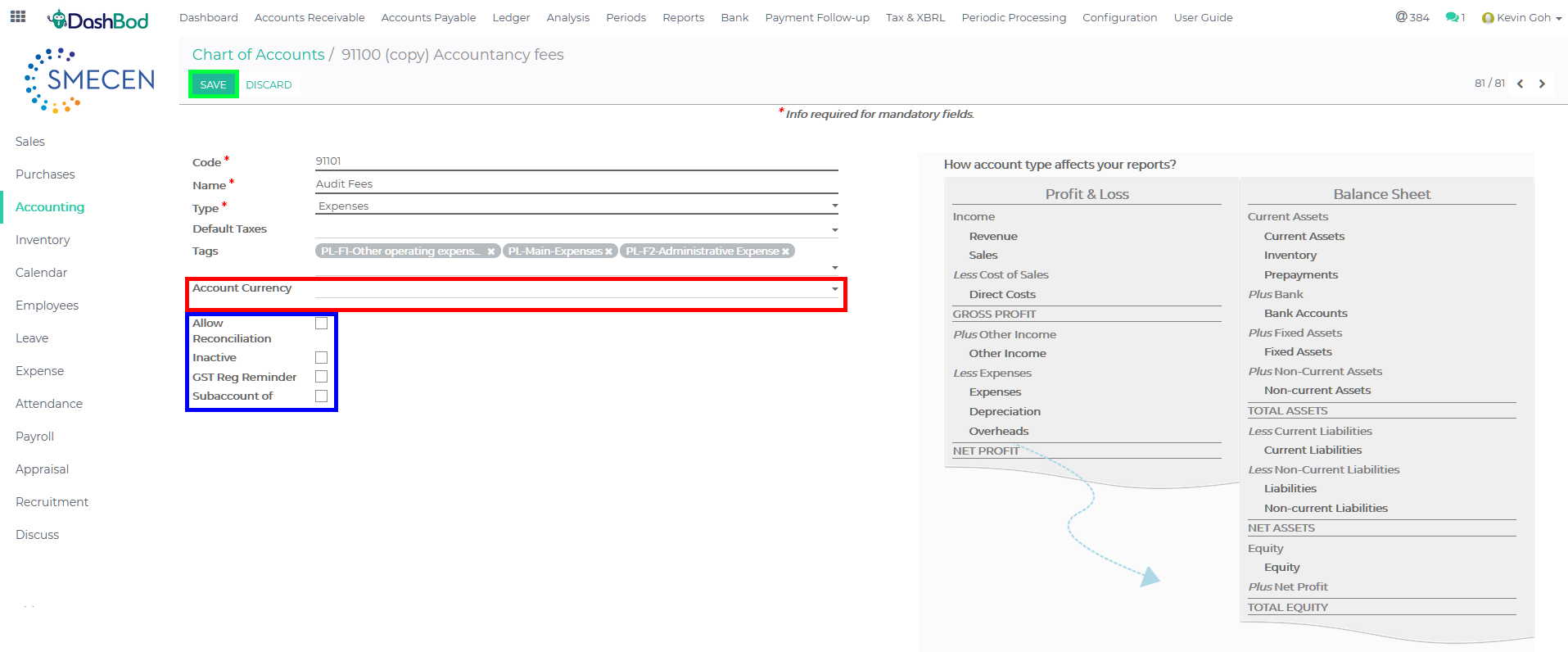

Additional Chart of Accounts Settings

9. Enter Account Currency (Optional: If only it is not SGD account) (Red Box)

10. Check the following box if needed (Blue Box)

-

- Allow Reconciliation

- Inactive

- GST Reg Reminder

- Sub-account of

11. Click Save once done (Green Box)

What’s Next

You can now start creating Journal Entries, Invoices and Supplier Bills.