Introduction

DashBod Auto-Matching Bank Reconciliation feature reduces the need to manually match transactions against the bank statements. This feature also reduces the possibility of misread receipts and data entry errors.

DashBod Auto-Matching Bank Reconciliation is one of the most popular feature among our partner accounting firms as this reduces their work tremendously when managing multiple customers’ books.

The video below complements the guide on the steps to take using DashBod’s Auto-Matching Bank Reconciliation.

Before you begin

For OCBC Business Banking users, link your OCBC Business Banking Account to DashBod before you start. Otherwise, import your bank statements into the system before you begin reconciliation.

Navigating to bank statement

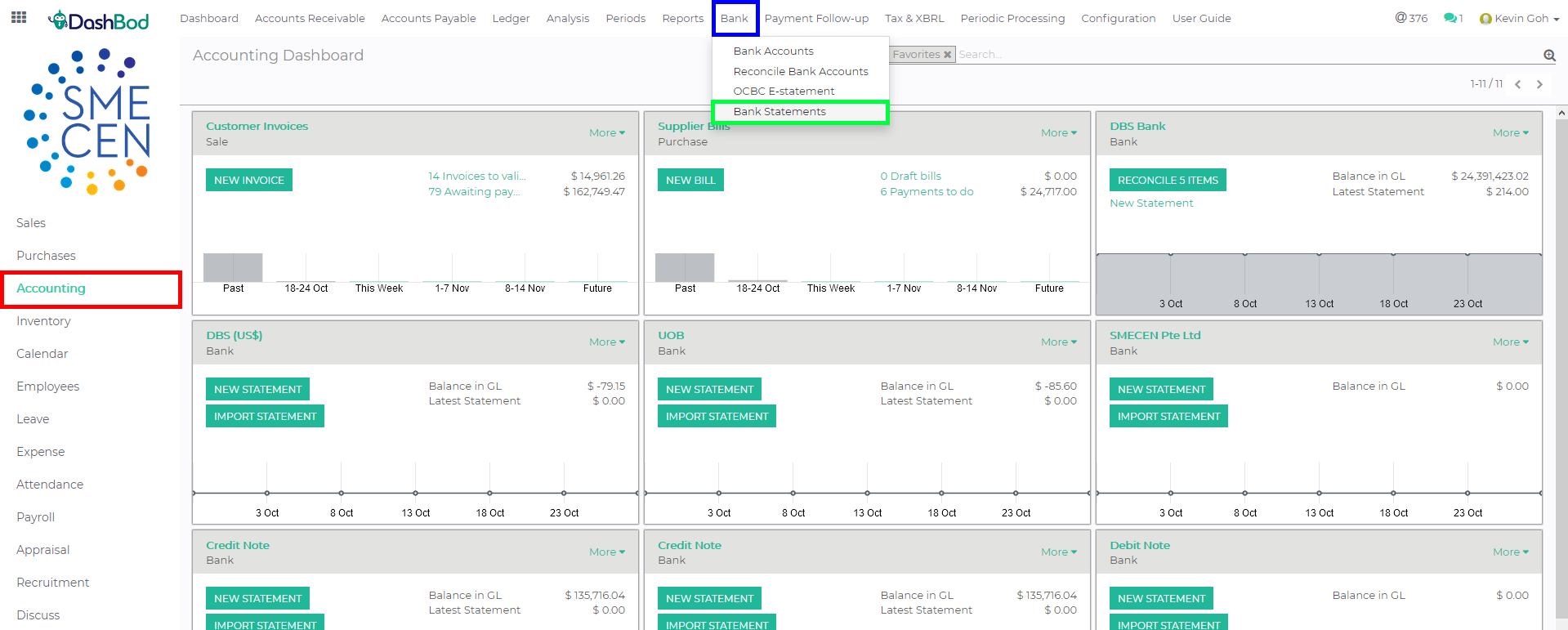

1. Click on Accounting at the left panel (Red Box)

2. Click on Bank at the top bar (Blue Box)

3. Click on Bank Statements (Green Box)

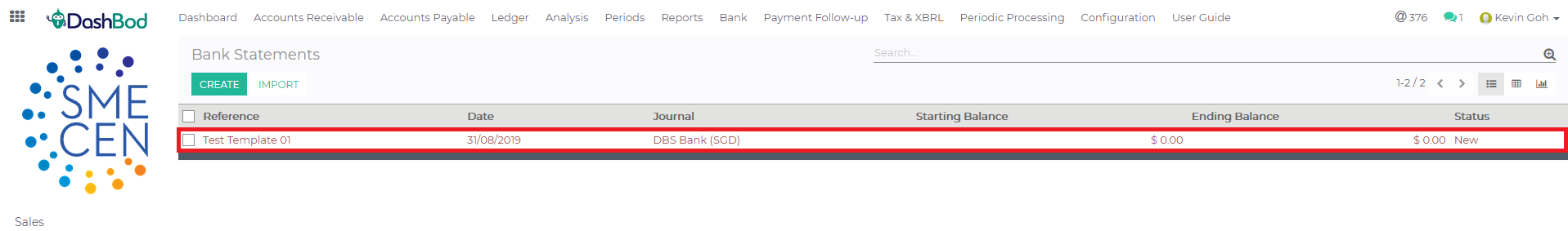

4. Select the bank statement to reconcile

Checking and matching

5. Check the imported statement (3 Red Boxes)

-

- Journal

- Date

- Stating Balance

- Ending Balance

- Transactions

- Computed Balance

6. Click Edit if necessary (Blue Box)

7. When all details are in order, click Reconcile (Green Box)

Reconciliation

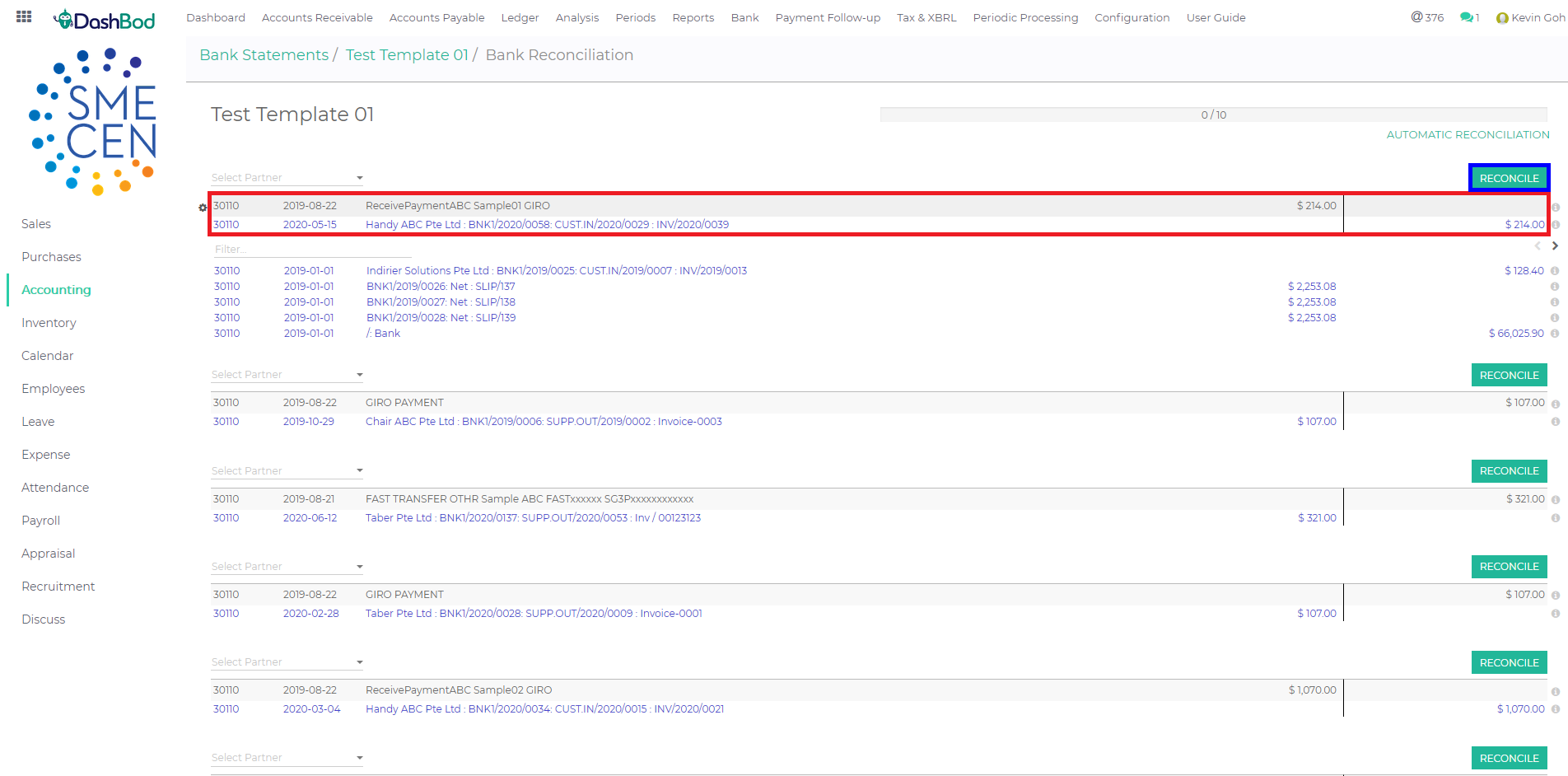

8. DashBod should have matched the transactions to your bank statement at this point (Red Box). Please refer to Step 10 if transactions are not matched automatically.

9. Click Reconcile once the transaction has been matched correctly (Blue Box)

When transactions do not match

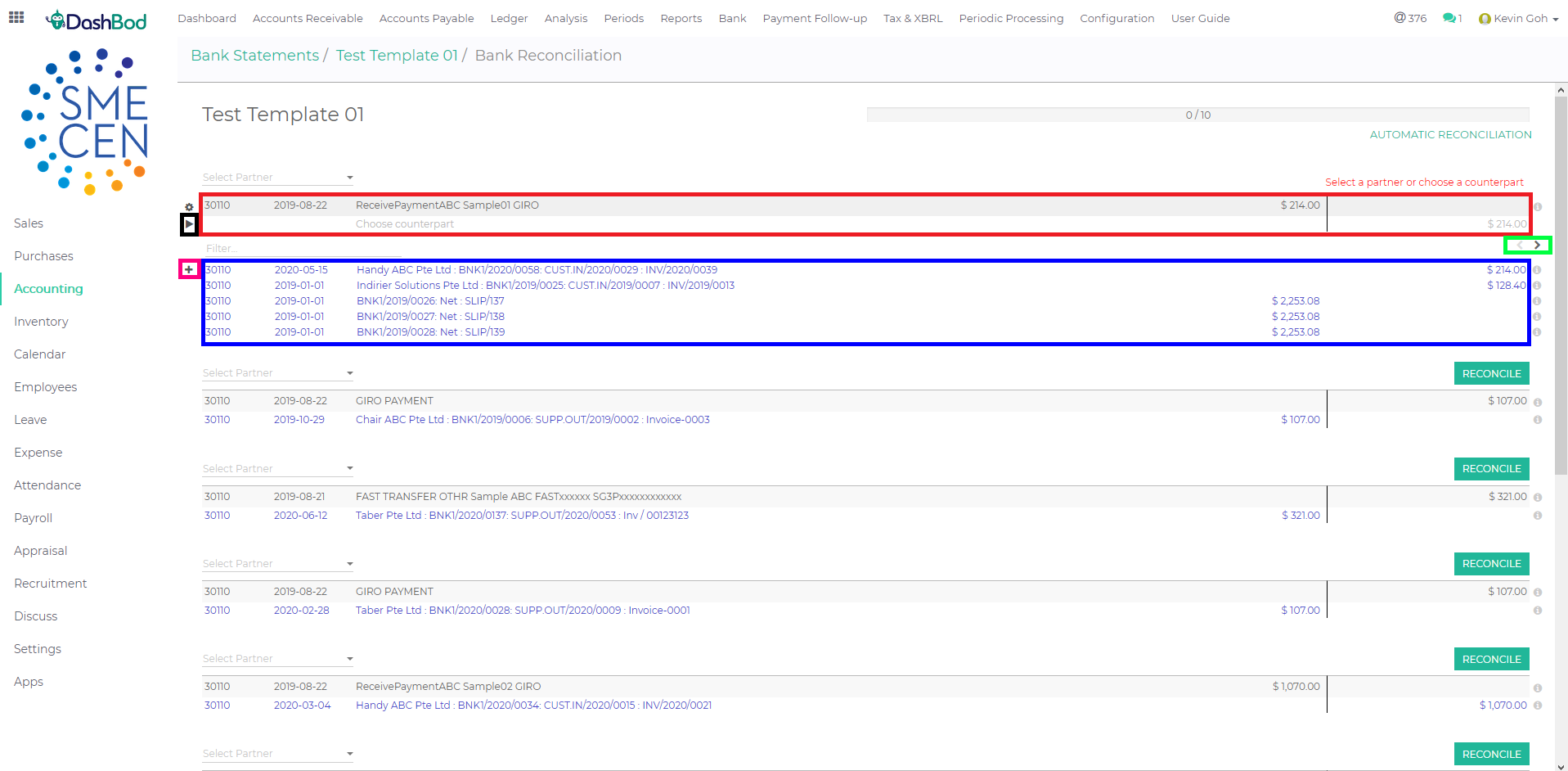

10. When a transaction does not match (Red Box), you may select the matching transaction from the Blue Box or scroll through the different pages (Green Box) to look for the matching transaction.

11. Click on the + (Pink Box) if you have found the matching transaction

12. Click on the > (Black Box) if you are unable to find the matching transaction. This allows you to manually insert the double entry.

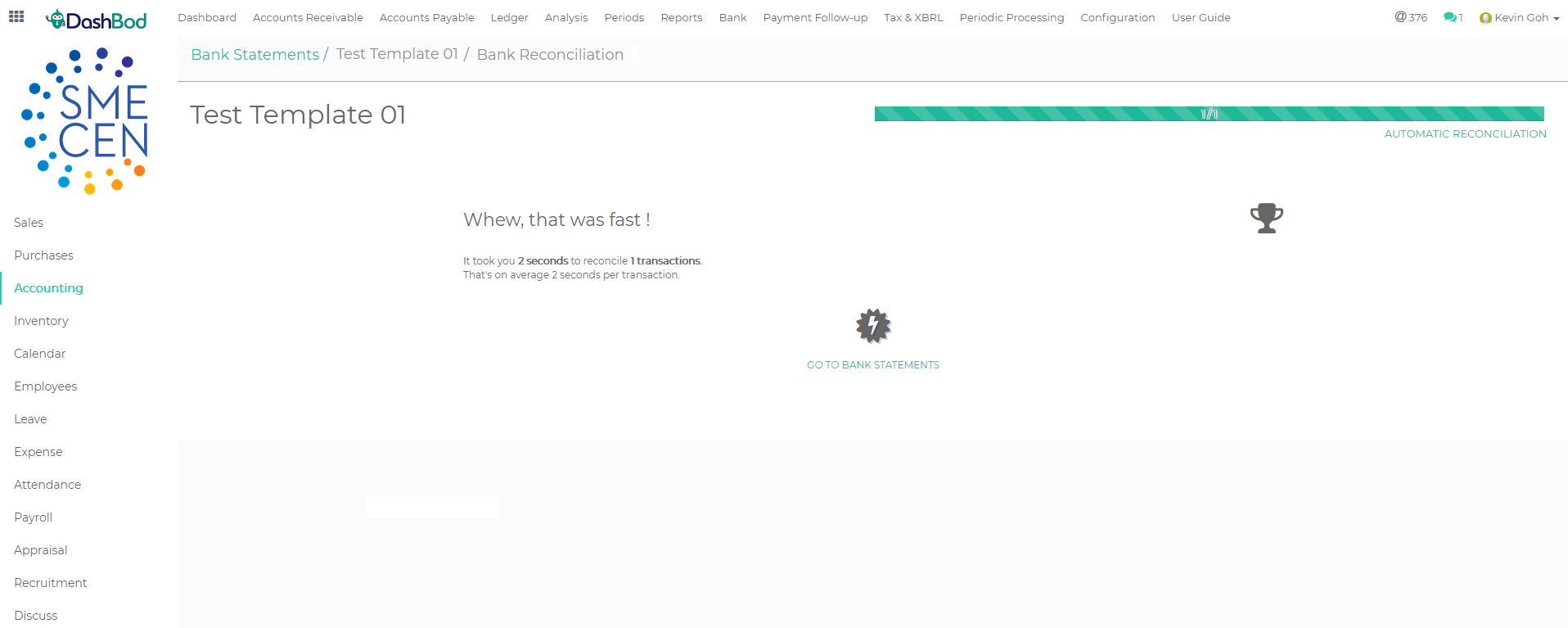

13. Once you have successfully reconciled all your transactions, you will arrive at the screenshot shown below

What’s next?

Now that you have reconciled the suggested transactions from invoices and bills against your bank statement, look at the remaining bank transactions that were not reconciled and create invoices or enter bills to fully reconcile your books.